MVNO Wholesale reality of pricing, risk and trust

MVNO wholesale partnerships often start with networking, conversations and building trust. You exchange views, you test whether there is alignment and whether it makes sense to continue talking. That stage is important, but it only takes you so far.

The moment you expect a real proposal, the tone changes.

“Telecom industry does not run on narratives. It runs on discipline, predictability and the ability to stand behind what you say.”

People recognise confidence, preparation and realism quickly. They also notice when these are missing behind a nice story. If you truly understand how wholesale works, know what must be considered and actually do the work, everything changes.

Wholesale reality starts where storytelling ends.

You’re no longer presenting ideas. You’re showing that you can defend them. And suppliers appreciate that – because it signals someone they can believe in, support and treat as a potential healthy partner.

What you will learn

After reading this article, you will understand:

- how wholesale works beyond “bundles”

- how suppliers interpret your forecast, risk and potential

- how to start building a good business case that will support you long-term

A quick note on context: the perspectives in this article are shaped over time mainly by working with European and global wholesale suppliers, as well as domestic MNOs, mostly in Europe, but not only there. Wholesale dynamics can differ by region, particularly when compared to the US market.

That said, the core principles discussed here (credibility, risk, commitment, forecasting discipline and long-term trust) apply everywhere. What is offered by suppliers may differ by region, but the mechanics of wholesale decision-making remain surprisingly consistent.

Understanding Wholesale reality behind the MVNO pricing

To know what is realistic when it comes to pricing, you need to see how wholesale actually works in practice. Even if the offer you receive looks simple, the mechanics behind it are more complex.

“Somewhere in the chain, there is always a traditional wholesale layer – and its rules still apply. “

Costs exist.

Risk exists.

Commitments exist.

This is the real-world economics behind mobile services.

Pricing Reflects Where Risk Sits

And this is exactly why working in wholesale is not only about buying capacity. It is about understanding what you are entering into. Once you operate in a wholesale reality, you become part of a financial and operational chain with dependencies.

Someone is always carrying the cost.

Someone is carrying the risk.

Someone is accountable for delivery.

To function well in this ecosystem, you need to know how to operate within those rules – not to overcomplicate your model, but to be realistic, credible and taken seriously.

There is no magic in excellent pricing

A wholesaler offering you an “unlimited” package to 98 countries in a World Zone 1 product is not doing magic. They are managing risk, leveraging scale and in some cases earning from breakage.

The complexity does not disappear. It is simply priced accordingly considering the risks and closely monitored.

EU roaming is Roam Like At Home for EU end users, but remains a cost consideration for operators (including MVNOs that step fully into wholesale). Wholesale still exists, only with regulated caps and operators continue to settle traffic balance through bilateral roaming agreements.

Once you realise that connectivity bundles are not “magic” and that wholesale economics sit behind everything, it becomes clear that someone is always carrying the cost and the risk. Bundle pricing and the policies around it are the result of structured decisions and protection mechanisms, built on real usage experience – not shortcuts.

“ Wholesale is not just about what you buy, but about how the economics behind it are managed.“ This is the part many people underestimate at the beginning.

Every MVNO eventually chooses a business model

From that point on, every service provider eventually faces two different ways of building their business (applies both for domestic MVNOs and roaming players).

Both models exist for a reason.

Both can succeed.

But they come with very different levels of responsibility, risk and control.

“You must know which risks you accept and which you refuse.”

Model 1: Play it safer with a simple cost structure (Ready Bundles)

Low risk.

Easy entry.

Lower margins.

More predictability.

More common.

Model 2: Accept more risk and build your own offering (True Wholesale)

More demanding. You need resources, confidence and a good grasp of telecom. But far more powerful long-term, if managed well.

You can build a customised proposition and make changes on your own. However, the second path is not for everyone. You will own the responsibility. You will manage cost changes. Billing is more detailed in this model.

“In the beginning, your traffic patterns will not be stable.”

In the early phase, it may feel a little like being a day trader: exposure, nerves, and constant balancing. And sometimes, yes, you will lose money on heavy users where breakage matters. This is part of phase one.

If you survive phase one, you reach phase two: more users, more predictability, more leverage. The effect of scale.

Pricing will always be part of the journey.

Forecast vs Commitment – the truth

A forecast is not a story – but its value depends entirely on where it comes from. If it’s based on clear assumptions, market understanding, and a realistic growth plan, it carries weight. If it’s simply ambition without substance, suppliers will treat it as such.

You need to be able to defend your numbers. Explain what they are based on. That is what suppliers look for: not “big numbers”, but numbers with a backbone.

“In wholesale, excellent pricing rarely exists without a volume or minimum commitment.”

The risk of presenting a high forecast is that it usually comes with high expectations. On the other hand, sometimes a very small business case simply won’t get attention, and suppliers may not seriously engage unless they see potential.

For suppliers, pricing is not only commercial – it is a risk decision. Lower predictability means higher risk and therefore more protective pricing. Higher predictability reduces uncertainty and is easier to justify internally.

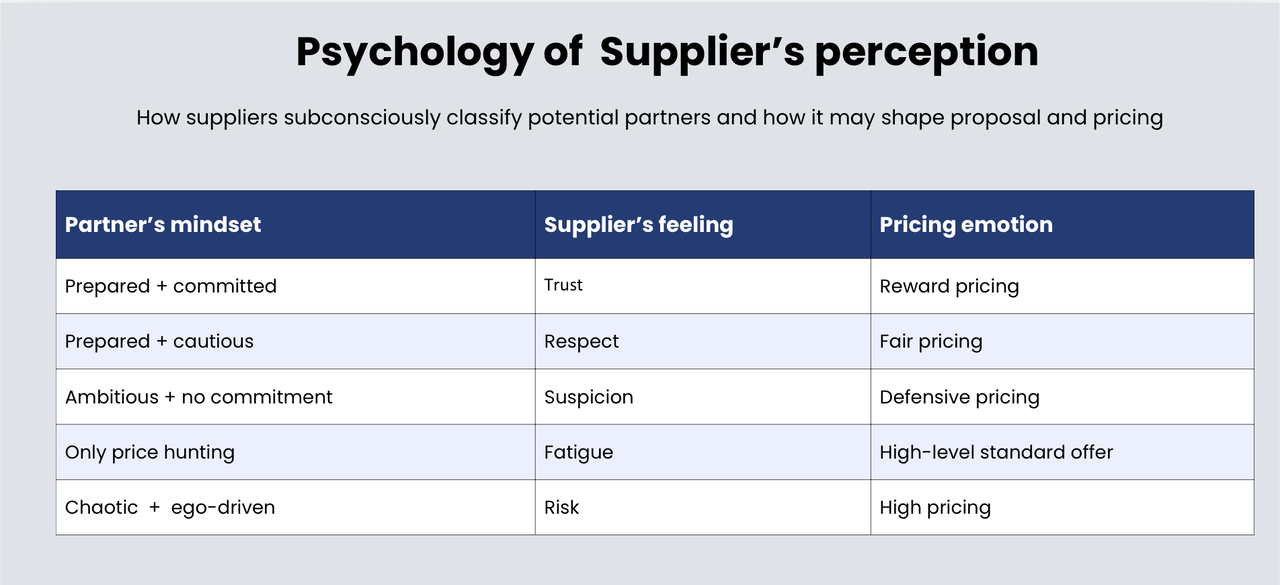

To make it easier, I’ve summarised this dynamic visually:

The table above shows how suppliers tend to classify partners based on forecast and commitment and how that can influence initial pricing in practice.

A Practical Guide to Building Your MVNO Business Case

Building a business case that holds

Your numbers need to be defensible. You can prepare two scenarios (for example one realistic and one optimistic), but both must have logic behind them and reflect something you can actually follow through.

The business case is work.

Nobody loves it.

Everyone needs it.

It won’t feel exciting to do a business case. But Quote “if you have a solid template and you do it right in the beginning, it pays off later.”

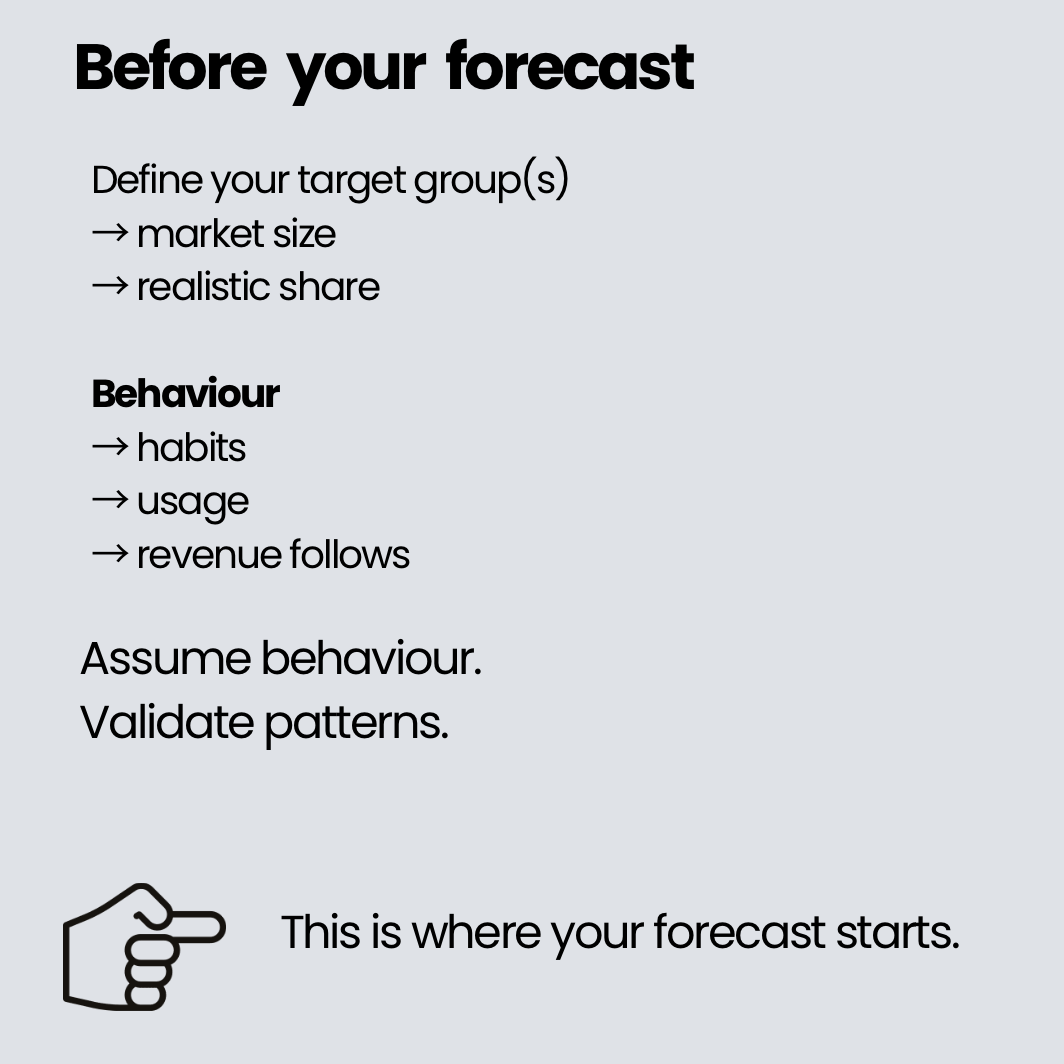

Assumptions Come First

You need assumptions.

If your reach is global, split your model country by country (or at least your top 10–20 destinations). If you operate locally, split it per domestic operator. Do this also for the purpose of your pricing exercise.

Look into market share, statistics, behaviour patterns, device reality, seasonality.

Write your assumptions down so you can update them when real data comes.

Patterns will change.

These are only your initial assumptions.

You may be wrong, but you need to start somewhere.

Stress-test your logic.

Accept what reality looks like

Also accept that:

- not all subscribers will generate traffic

- not all purchased SIMs will be activated

- refunds exist

- behaviours evolve and never fully follow the presentation deck

- for postpaid: there will be churn

“Your business case should reflect reality. Assume higher usage, but fewer subscribers actively generating traffic. Assume delays. Give yourself a ramp-up period. Don’t force unrealistic activation growth. It takes time.”

Your numbers need to be defensible. You can prepare two scenarios (for example one realistic and one optimistic), but both must have logic behind them and reflect something you can actually follow through.

Also accept that:

- not all subscribers will generate traffic

- not all purchased SIMs will be activated

- refunds exist

- behaviours evolve and never fully follow the presentation deck

- for postpaid: there will be churn

“Your business case should reflect reality. Assume higher usage, but fewer subscribers actively generating traffic. Assume delays. Give yourself a ramp-up period. Don’t force unrealistic activation growth. It takes time.”

Know What You Are Building Toward

The goal is not to produce a perfect forecast. The aim is to understand where your break-even point is and when you can realistically reach it.

Benchmark the market. Understand what pricing you need to be competitive enough to exist and grow.

That clarity will matter long before any negotiation begins.

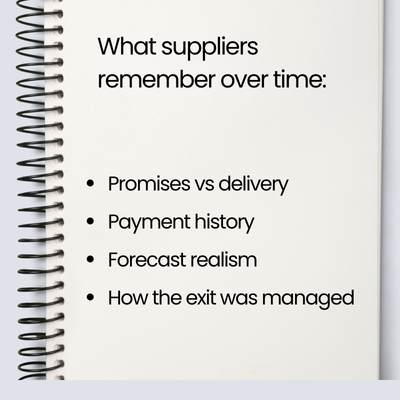

Telecom industry has an elephant memory

The best wholesale relationships are never only about buying and selling. They learn, they grow, they mature.

“Early conversations are not “informal warm-ups”. They already set the tone of the future partnership.” They reveal realism, maturity, and whether both sides truly understand what they are getting into.

If you walk in with:

- clarity and structured assumptions

- honest and realistic expectations

- You make a very strong impression.

- Suppliers treat you seriously.

They see someone prepared, grounded and clear about what they are looking for – not guessing.

And when that happens, you don’t just negotiate better.

Your position is already strong.

Even if you don’t close a deal, people meet again in telecom – often on the other side of the table. You will have already learned a lot from that round.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.