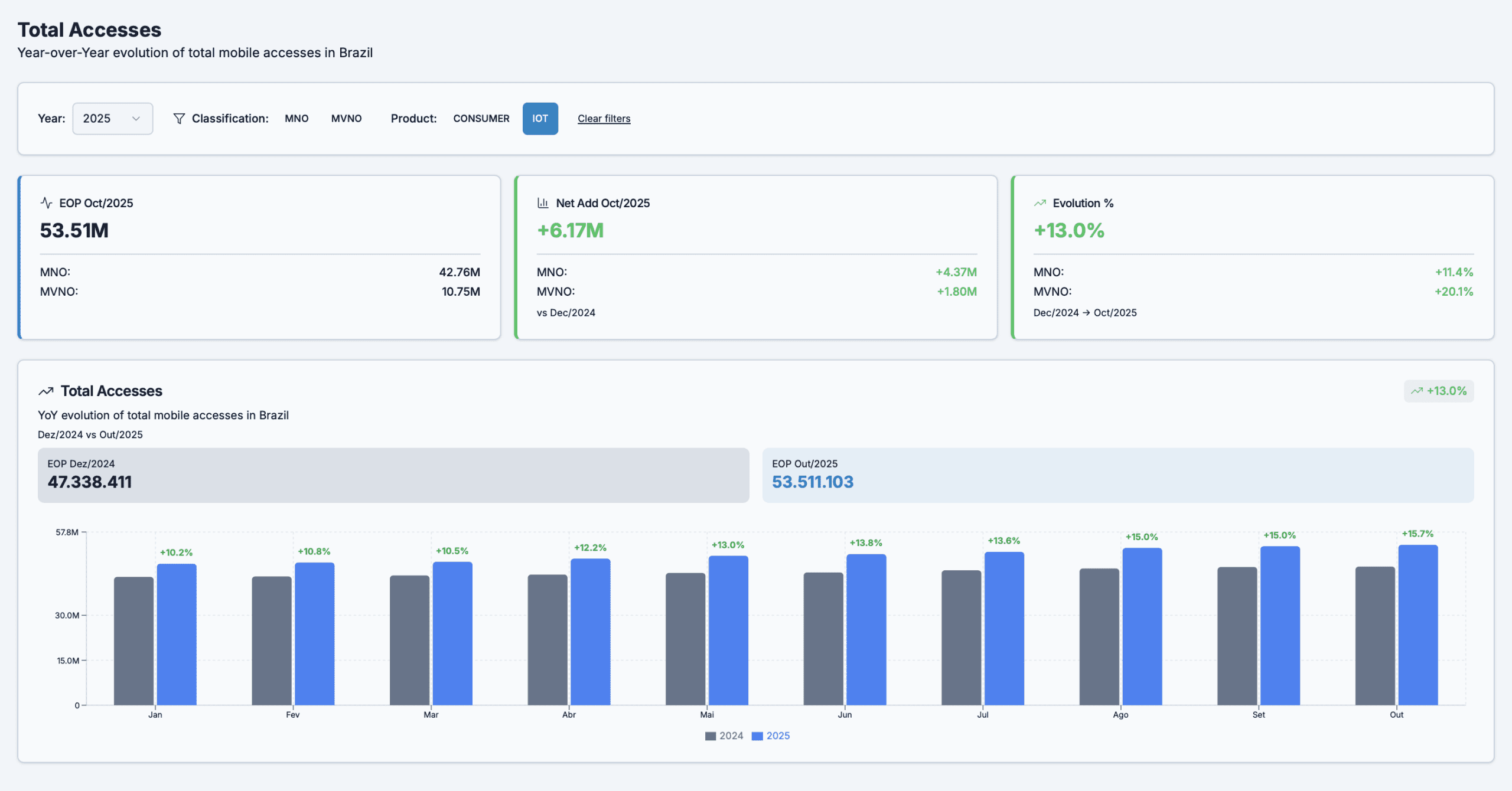

Even with all the challenges, the cellular IoT/M2M connectivity market continued to grow in Brazil. Data reported through Oct/25 shows an increase of more than 6 million connections, with over 20% year-to-date growth driven by MVNOs. The MNOs’ growth represented more than 4.3 million connections, accounting for over 70% of all IoT cellular accesses in 2025 and concentrated among the three national MNOs. The remainder is distributed among more than 10 MVNOs.

Source of data: ANATEL – 16/12/2025

These numbers show that, despite the progress made, the ongoing disputes in the telecom market to improve cellular IoT connectivity offers and boost competitiveness are justified — and deserve close attention.

Recently, I attended a meeting with global executives from the IoT/M2M connectivity industry, presenting the nuances of the evolving Brazilian regulatory landscape. The reaction, inevitably, is always the same: perplexity.

For professionals accustomed to regulatory regimes that are clear, stable, and predictable, Brazil often feels like a territory where “the rules constantly change, and not always in the way one expects.”

In Brazil, we often hear three common sayings that perfectly capture the feeling of this ecosystem:

- “Brazil is not for amateurs.”

- “In Brazil, even the past is uncertain.”

- “If you can run a business in Brazil, you can run a business anywhere in the world!”

That last one is a constant reminder that the challenges here are not flaws, they are filters for resilience and opportunity. The summary of what we experienced in 2025 may look challenging at first glance. But, like every pragmatic Brazilian, I remain optimistic and focused on identifying the opportunities hidden within the changes unfolding around us.

Regulation in motion: progress, promises & uncertainty

The new General Competition Goals Plan (PGMC 2025, Resolution nº 783/2025) represents a necessary regulatory milestone. Anatel updated how it defines Significant Market Power (SMP), introduced multifactor criteria, and added greater formal structure to the analysis of relevant markets, including national roaming and wholesale offerings.

But the execution has revealed gaps and friction points that need to be confronted head-on.

The real impact of the PGMC on IoT/M2M MVNOs

On paper, the PGMC redefined the regulatory framework for Wholesale Reference Offers (ORPA). In practice, however, several companies made investment decisions, shaped their business models, and in some cases even entered Brazil based on regulatory expectations that did not materialize on time or in the expected manner.

Two critical concerns stand out:

- The end of regulated per-subscription access charges in MNO-MVNO agreements; and

- The allowance of exclusivity clauses in contracts between an MVNO (authorized entity) and its hosting MNO, limiting the MVNO’s ability to negotiate with multiple network providers.

The result:

Access subscription charges are now allowed but without a clear regulatory framework around wholesale offers. At the same time, authorized MVNOs must have contracts with only one MNO. This shift has created significant legal uncertainty, especially for companies that obtained authorization licenses in 2024 and 2025.

The practical effect has been a surge of contractual disputes between operators and MVNOs in recent months, disputes that Anatel may now need to evaluate individually, reinforcing the perception that instead of reducing asymmetries, the new environment may have opened the door to deeper contractual uncertainty.

Brazil “invents the future while the world is still debating the past”

Globally, we discuss topics such as regulated roaming, industrial-scale monetization of connectivity, and business-oriented network architectures. In Europe and North America, these conversations translated into clear wholesale policies, secondary spectrum regimes, and incentives for innovation. In Brazil, part of this dialogue still happens reactively, not proactively.

And that’s not necessarily a weakness. It’s a feature.

We operate in a market with massive IoT/M2M growth potential, but one that still carries structural uncertainties that shape business decisions and investment frameworks.

Positive signals: tax relief & institutional strengthening

Not everything in 2025 fueled perplexity. There were significant advances:

1. Extension of the tax exemption for IoT/M2M devices until 2030

A coordinated effort (including an industry study led by Telcomp) showed that exempting regulatory taxes (TFI/TFF) on IoT/M2M devices increases overall tax collection by enabling scale and accelerating digitization. The exemption was extended until 2030, providing regulatory and financial breathing room for high-volume, low-ARPU models.

2. Creation of a Telecom and Digital Solutions Parliamentary Front

On December 16th, the Mixed Parliamentary Front for Telecommunications and Digital Solutions was launched, giving the sector a formal and ongoing political voice on priorities such as connectivity infrastructure and nationwide digitization.

This front is supported by the Brazilian Institute of Telecommunications and Digital Solutions (IBTD), which will operate through six committees:

- Infrastructure, networks & sharing

- Spectrum, satellite & space

- Emerging technologies & AI

- Universalization & digital inclusion

- Cybersecurity, data protection & digital media

- IoT & M2M

These developments reinforce that, despite the challenges, institutional evolution is underway.

Legal uncertainty: the cost of a market in transition

The perception of legal uncertainty in 2025 does not negate the progress, but it reveals the complexity of regulating a market that is simultaneously:

- migrating technologically (sunsetting 2G/3G; adopting NB-IoT/LTE-M),

- redefining wholesale models,

- recalibrating commercial frameworks,

- navigating bilateral contracts driven more by negotiation power than sectoral efficiency.

The three major legal concerns that emerged in 2025 were:

- Lack of clear wholesale rules specific to IoT/M2M MVNOs;

- Debates over exclusivity and contractual freedom in roaming and access, directly affecting diversification strategies;

- Temporary tariff uncertainty, especially in national roaming, while cost-based models (LRIC) are still under development.

This is not an academic nuance. It affects real-world decisions made by CFOs, COOs, and CTOs, shaping:

- revenue models,

- contract negotiations with integrators and enterprise customers, and

- coverage rollout planning for critical services.

Why I remain optimistic

Yes, 2025 brought challenges and frustrations, no point denying it. But as any Brazilian who has weathered true storms knows, opportunity tends to emerge exactly where the change happens.

Entering the Brazilian market without deep understanding of how regulation, market dynamics, and operations interact is like climbing a mountain with no map or GPS. It can be done, but the risks are high.

The positive truth is that Brazil did not just arrive to the IoT game. We already have:

- a significant installed base of connected devices,

- local expertise in network and platform operations,

- global players testing and learning here,

- a business environment that rewards persistence and adaptability.

Which is why I firmly believe that if you aim to compete and lead in IoT/M2M in Brazil, you must carefully choose who is by your side in this journey. Partners who truly understand the game locally, not just the theory make all the difference between merely surviving and truly scaling.

Conclusion

Brazil in 2025 was a complex, paradoxical, and multifaceted environment. Perplexity abroad? Absolutely, and for good reason. But within that complexity lies a unique opportunity:

those who master the nuances of this environment will gain strategic advantage not just regionally, but globally.

IoT/M2M in Brazil is not just a use case.

It is a national-scale business.

And continuing to treat it as merely an engineering issue, a regulatory issue, or an operational issue is missing the point:

Machine connectivity is economic infrastructure.

Those who understand this first will gain lasting competitive advantage.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.