We will begin this analysis by thanking the CNMC for its commitment to transparency, providing the public with a valuable source of information on the dynamic telecommunications market. This accessibility is fundamental for all stakeholders in the sector, from operators and sellers to consultants and end-users.

The wealth of data provided by the CNMC has encouraged us to complete a study that we started in November 2023. Initially, we planned to publish an article for a specialized journal at the end of the year. However, the intense activity of the sector in the last months of 2023, marked by the merger of MásMóvil and Orange and the emergence of Silbö, made it evident the need to delay our analysis and present a more updated version.

The appearance of Silbö, which received its license as an MVNO service provider on December 20, 2023, and announced in March 2024 an ambitious goal of reaching 1.2 million accesses by the end of 2027, represents a significant milestone that we could not ignore. This new player, along with the consolidation of the market, raises crucial questions about the future of MVNOs and the competitive dynamics of the sector.

Just one more? No, surprisingly in Spain we found 905! (5 more than in November 2023), that is the number of virtual mobile operators returned by the query to the CNMC (https://numeracionyoperadores.cnmc.es/operadores) in the operator registry, as of 05-08-2024, 40 of them appear as full virtual mobile operators (4 less than in November 2023) and 865 as virtual mobile operator service providers, some operators hold both types of licenses, highlighting the complexity of the Spanish MVNO market and that it is a very high number.

Exciting changes are yet to unfold, but we must adhere to confidentiality protocols, preventing us from sharing details.

Let’s start by defining and differentiating these two types of MVNOs.

The aim of this text is not to provide a detailed explanation of the concept of an MVNO, as there is extensive literature available on the internet and specialized websites such as MVNO Index. Instead, we aim to highlight the interpretation of these models in Spain.

Generally, an MVNO is defined as an operator that provides mobile services to end users but does not have a government license to use its own radio frequency. I want to emphasize this definition because it is common to find many articles or references to MVNOs as operators that lack infrastructure, when the correct term is that they do not have a radio access network or a license to use mobile service frequencies.

From the perspective of Spanish institutions, we can say that the CNMC (National Commission of Markets and Competition) only differentiates between full MVNOs and service providers, not considering a very widespread type of MVNO, such as white-label brands. In the quantitative analyses that we will see in this article, we will only see references to full MVNOs and service providers, although many of them are actually resellers of the service.

Let’s take a walk through the history of MVNOs in Spain and their current situation

The CNMC (National Commission of Markets and Competition) analysed the wholesale market for access to mobile networks in 2006 and imposed a regulation that forced the three existing network operators at that time (Telefónica, Vodafone, and Orange) to provide reasonable access to their mobile infrastructures. It was this regulation that led to the opening of the market and with it the entry of the fourth network operator (Yoigo) and companies that did not have radio spectrum, the so-called Mobile Virtual Network Operators (MVNOs). Thus, these new operators began to progressively offer voice and mobile data services to their customers.

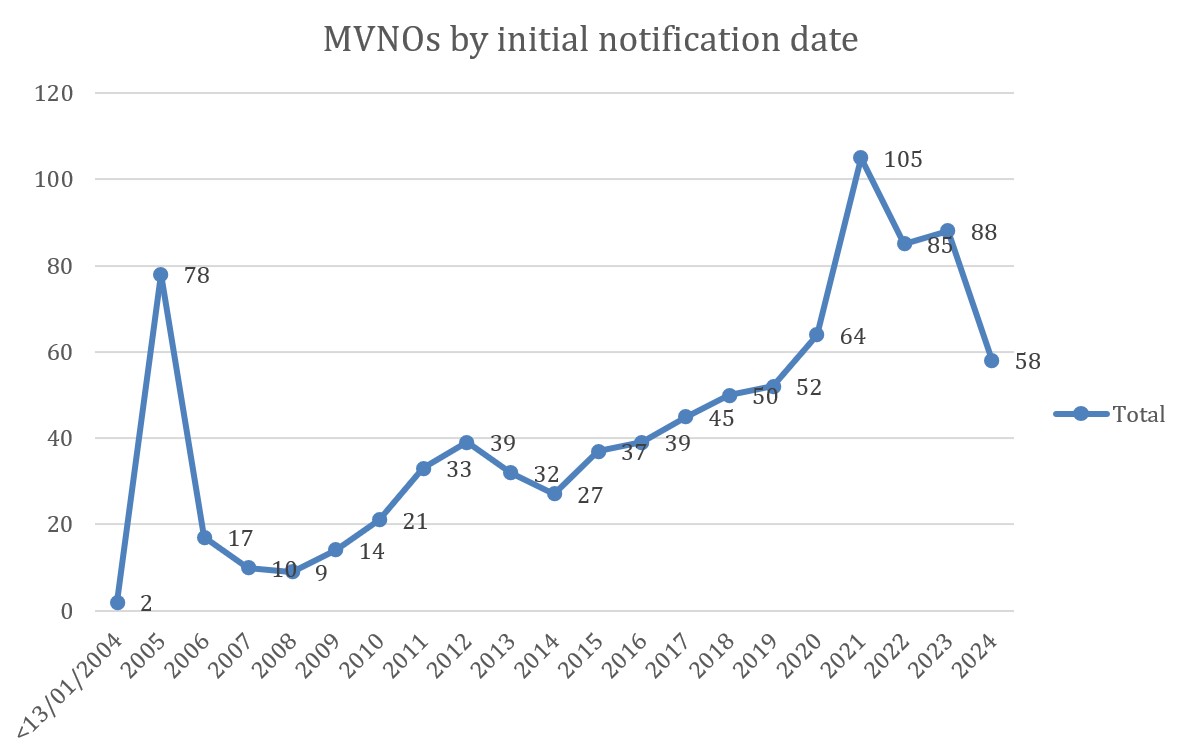

So, it’s not a new concept, is it? No, according to the CNMC’s data on license notifications, this is the chronological distribution of such notifications.

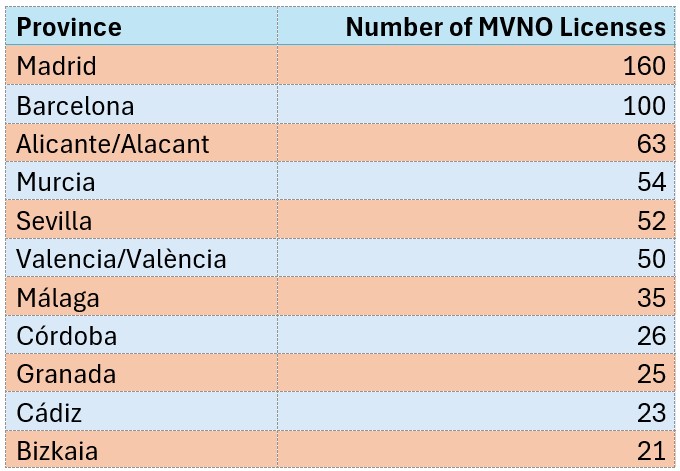

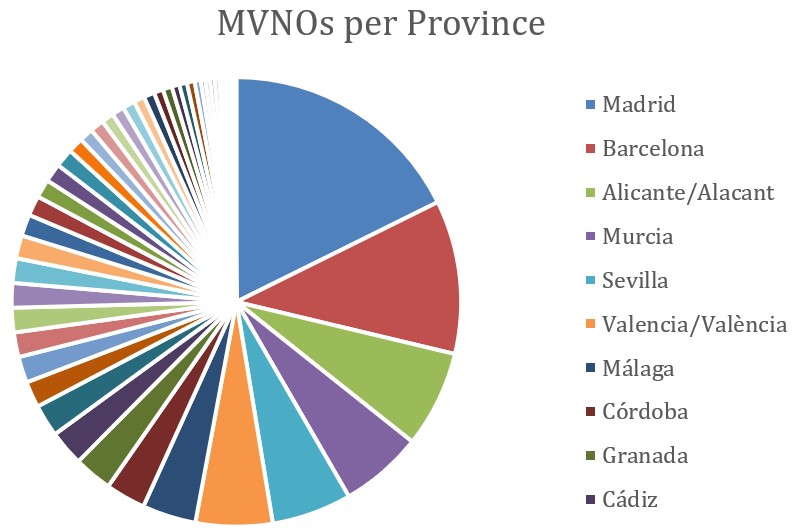

With so many MVNOs, what is their geographical distribution? As expected, Madrid and Barcelona lead the ranking, although it might be surprising that the following provinces all belong to the regions of Valencia and Andalucia.

To explain this phenomenon, we must go back to cable operators’ history that forged their identity based on the experiences of community video and CATV (Community Antenna Television). The emergence of these operators took place in the 1970s and 1980s, especially in the Mediterranean area (Catalonia, Valencia, Murcia and Andalucía), where an administrator sent, through the collective television antenna system, the signal from a video player.

From those beginnings in the 80s with cable services, we evolved to a quadruple play model, including mobile telephony, which has led to this great atomization and how some actors at that time are currently MVNOs of renowned prestige such as Procono in Córdoba.

Is there room for so many?

What does it mean to be a Mobile Virtual Network Operator (MVNO), then? What are the differences between them?

If we look for other sources of information to verify these figures, we will find that in the AOPM (Association of Operators for Mobile Portability), on that same date, there were a total of 42 associates, compared to 41 in November 2023, due to the appearance of Silbö. Among these, we must of course include mobile operators with their own access network (OMRs), which gives us an idea of the reality of actors in the user portability market.

Now a little quantitative analysis.

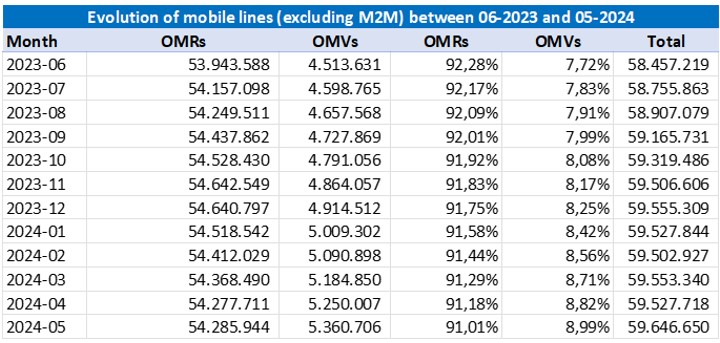

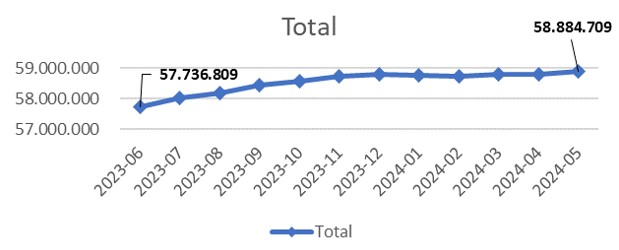

Current situation. According to CNMC statistics, the evolution of mobile lines during the months of June 2023 and May 2024. We can see that the growth of the mobile lines park as a whole has grown by a total of 1,189,431 net lines in the last 12 months, which represents a not inconsiderable 2.03%.

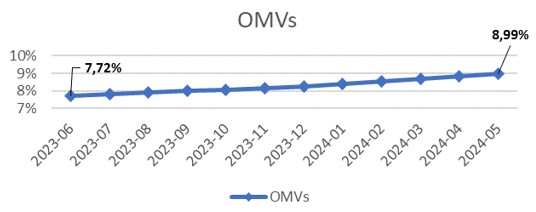

but let us focus our attention on the protagonists of this article, the MVNOs, of that previous amount, the set of MVNOs grew by 847,075 lines, which represents an 18.77% growth in that segment and capturing 71.22% of the new lines compared to the growth of 0.63% (342,356 lines) of the set of MVNOs, which would have captured 28.78% of those same new lines.

This growth is also reflected in the weight of MVNOs in the total market, which is continuously growing and gaining market share.

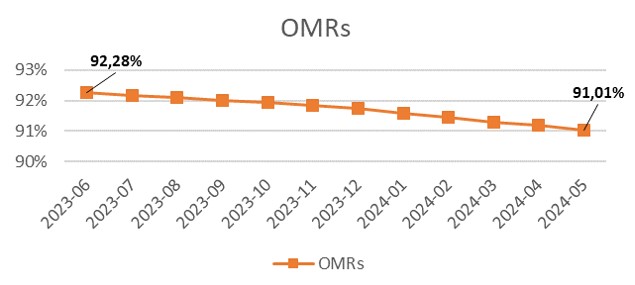

Regarding the evolution of the OMRs, which, despite achieving positive net growth, see a reduction in the weight in the number of lines.

This trend continues, in percentages very similar to those of the previous year.

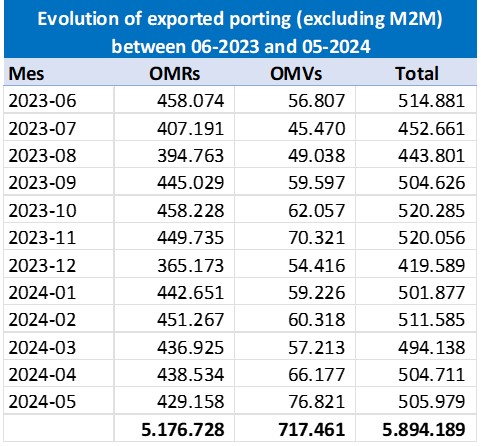

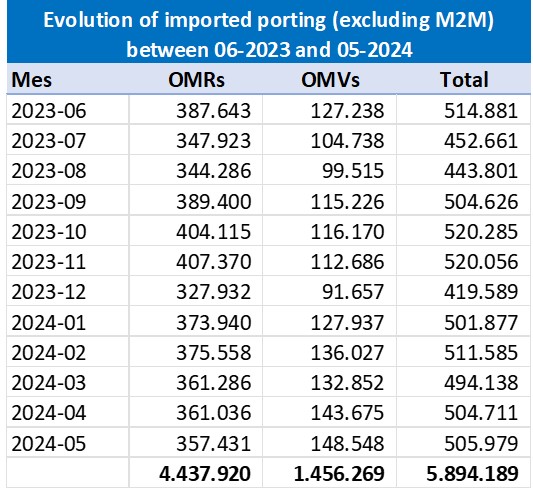

We cannot close the quantitative analysis without analysing how churn and the transfer of lines between operators work, and we see that in the period analysed there is a total of 5,894 million ported lines (migrated between different operators), with a clear set of winners in the final reception of these lines, the MVNOs, which obtained a net gain of 738,808 lines from the MNOs, a figure that is repeated with respect to the previous year.

This figure, together with the total net growth, shows that MVNOs are not only benefit-ing from users migrated from MNOs, but from new subscriptions that ended up in their profit and loss accounts.

That’s not all folks

In the next chapter we will analyze the map of these MVNOs from another fundamental point of view for operators, that of numbering.

With only 4 mobile access networks (Telefónica, Vodafone, Orange and MasMóvil) that now become (Telefónica, Vodafone, MasOrange and Digi) it is very important to know who depends on whom and how that impacts their networks.

We will see you in the next chapter.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.