In the first part of this Guest Blog, we analyzed the size of the Spanish mobile market, focusing on the number of mobile lines and their distribution among different operators. The growing evolution of Mobile Virtual Network Operators (MVNOs) year after year became evident. Although licenses to operate as MVNOs were granted several years ago, it is in recent years that this segment has gained special relevance.

In this second part, we aim to illustrate how virtual mobile operators (MVNOs) are distributed in the market. As we know, an MVNO does not have its own mobile access radio network. Therefore, it must establish agreements with traditional network operators to utilize their infrastructures.

Before delving into the dependency relationships between different operators, it’s crucial to understand how a Mobile Virtual Network Operator (MVNO) is established in Spain. What are the requirements to become an MVNO? Additionally, we need to clarify concepts like number sub-allocations, which will enable us to delve deeper into the operations of these operators and their relationship with larger telecommunications companies.

Next, we will examine the specific requirements for an MVNO to operate in Spain.

Since 2003, the requirement to obtain a special permit to provide telecommunications services has been eliminated. Now, companies only need to register with the CNMC’s Operators Registry before starting operations. This administrative simplification should not be confused with less regulatory oversight, as the General Telecommunications Law imposes severe penalties on operators who fail to comply with this requirement.

We will not go over all the details to request such authorization, but some relevant aspects. In addition to the complete administrative documentation required, which includes the following documents:

- Formal notification to the National Commission of Markets and Competition.

- Reliable proof of the interested party’s identity.

It is necessary, an we will emphasize on some key points, a technical documentation including:

- Description of the network to be exploited.

- Description of the service to be provided.

- Functional description of the services

- Service offering and its commercial description (indicating whether the service is provided free of charge or for financial compensation and, where applicable, responsibilities to end users such as billing, technical service, customer service, etc.).

- Indication of the service or services to be provided, such as:

Virtual mobile operator providing the service (with sub-assignment of mobile numbering).

All documents must be submitted in Spanish or Catalan. If any document is in a foreign language, it must be officially translated into Spanish by a sworn translator and must also bear the Apostille of The Hague.

To have a detailed guide to request such authorizations you should follow official documents: https://sede.cnmc.gob.es/sites/default/files/2022-08/Guia%20Notificacion%20LGTel%202022.pdf

Therefore, some aspects such as customer service or billing are crucial and must be detailed in the applications.

But what is this about sub-assignment?

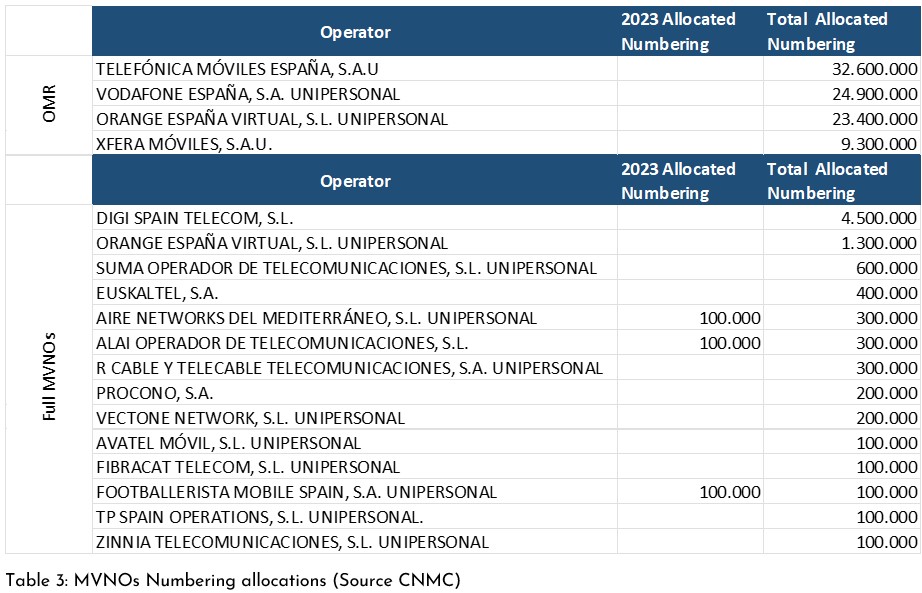

The CNMC assigns blocks of 100,000 mobile numbers to mobile network operators and to the so-called full virtual mobile operators. Operators that resell the mobile service (virtual mobile operators providing services) can access sub-assignments of blocks of mobile numbers.

In application of the MAN Regulation, the CNMC authorises by resolution the sub-assignments of certain blocks of mobile numbers to virtual mobile operators providing services, and said blocks are recorded in the Numbering Registry. In addition, virtual mobile operators providing services must contribute to the costs of maintaining the numbering by joining the Association of Mobile Portability Operators (AOPM).

The use of the assigned public numbering resources shall be subject, among others, to the following general conditions:

- The assigned resources must be used for the purpose specified in the application by the holder of the assignment.

- The assigned resources must remain under the control of the holder of the assignment. However, the holder of the assignment may, with prior authorisation from the Telecommunications Market Commission, make sub-assignments provided that the use to be made of the resources is as specified in the application.

https://www.boe.es/buscar/doc.php?id=BOE-A-2004-21841

Let’s look at access to public resources and the relationship between operators.

And now that we know the concept of sub-assignment, what is the access of these operators to public resources, and we are not talking about frequencies, but about numbering, that very important and scarce resource. It is very relevant to consider that Service Provider virtual mobile operators (MVNOs) do not have the right to direct numbering assignment, only Full MVNOs have, but they receive the sub-assignment of mobile numbers assigned to another operator, subject to authorization by the CNMC as explained above.

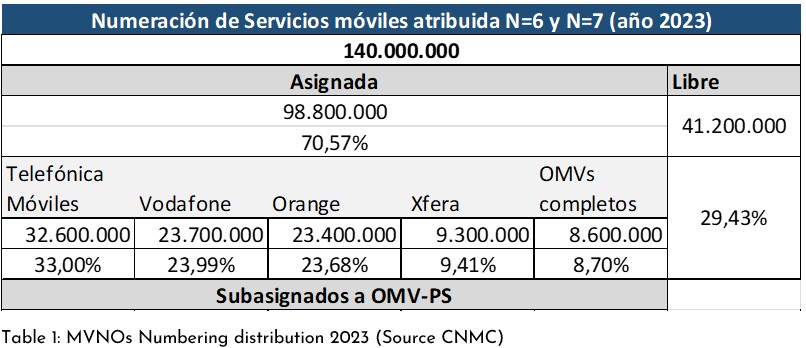

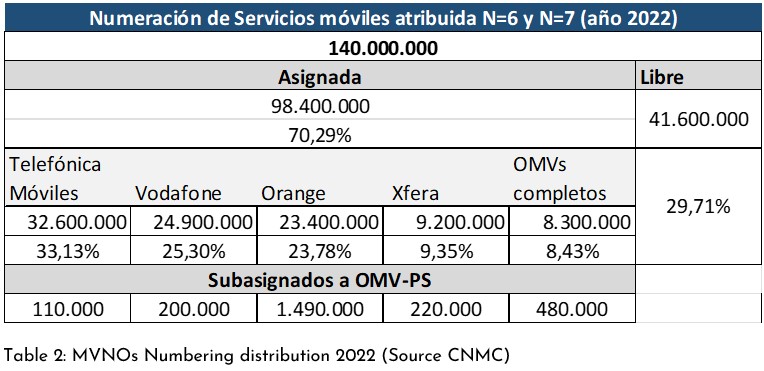

Based on the report on the numbering assigned to operators as of December 31, 2023 by the CNMC (NUM/DTSA/3393/23), we could determine that there is a great alignment, in relative terms, between the weight of the MVNOs in number of subscribers and the percentage of assigned numbering (10.59%).

Between 2023 and 2022 there was a slight increase in the numbering assigned to MVNOs, from 10.49% to 10.59%, unlike the previous year where the numbering assigned to all MVNOs fell from 15.38% to 10.49% (both the allocation to complete MVNOs and the sub-allocations of the 4 major operators to MVNOs are taken into account).

To explain this, the CNMC highlighted three movements last year, the merger between Vodafone Spain and Vodafone Enabler, as well as the completion of the migration of Lebara customers and the absorption of Lycamobile by Xfera.

These types of movements will undoubtedly be repeated in the coming years and the merger between Orange and MásMóvil (Xfera) itself will also have repercussions.

If we go into the details, below we can see a detailed distribution of the numbering including all operators with direct attribution/

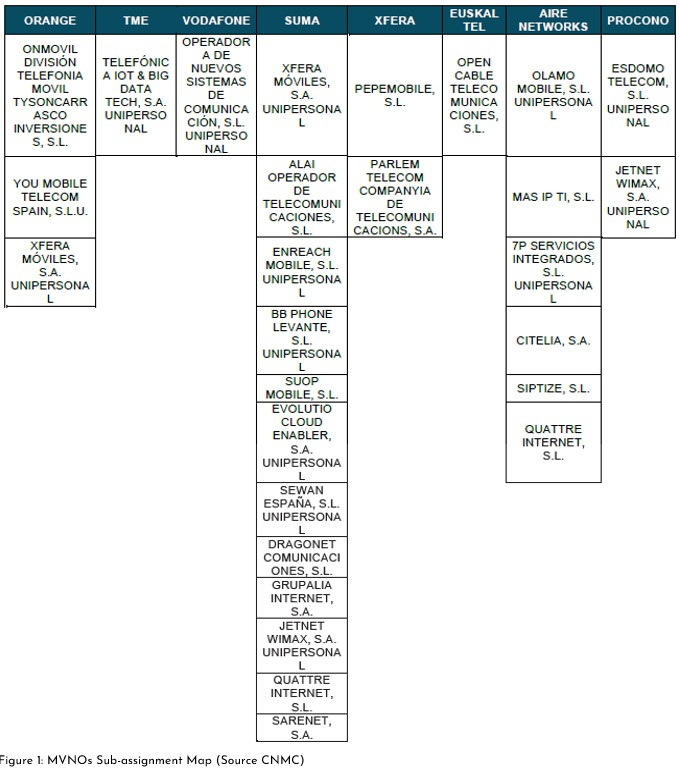

But what does this sub-allocation map look like?

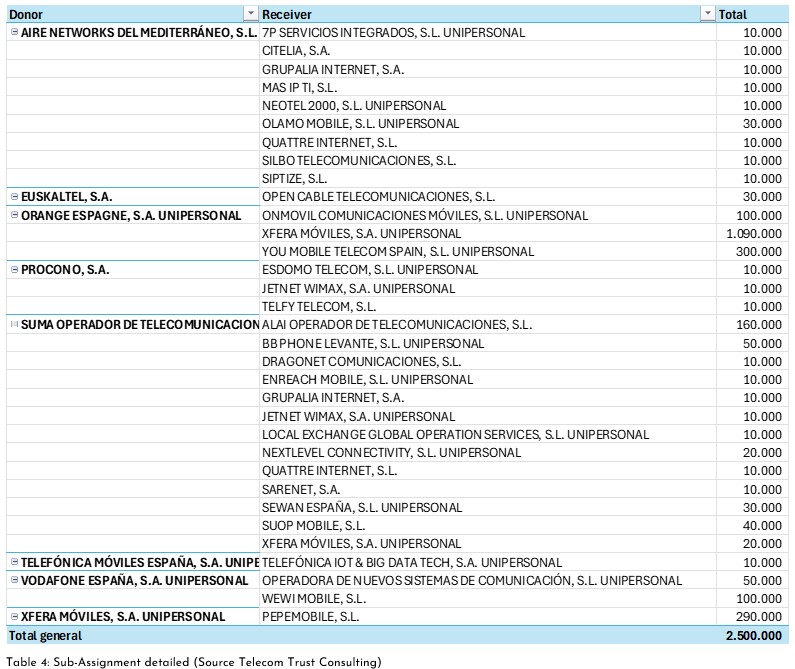

According to CNMC’s report on the numbering assigned to operators as of December 31, 2023 (NUM/DTSA/3393/23)this would be the map for sub-assigned service providers MVNOs

Table below details the current situation (August 2024) for these sub-assignment with a calculation on sub-assigned numbering.

For details on ranges and subranges allocated to each operator contact the author.

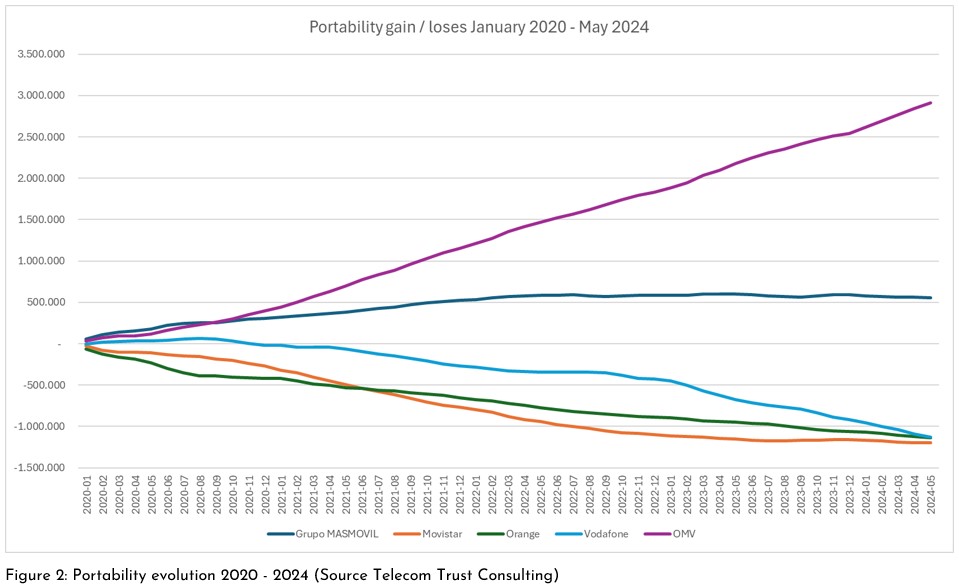

To end second part of Spanish MVNOs analysis we need to take into account that numbers allocations do not show the real number of subscribers per operator, we need to consider all portabilities (as the ported number moves from old operator to new one).

Below you can find a graph showing the net gain / loses evolution between January 2020 and May 2024. As clearly seen in all previous chapters of this analysis MVNOs.

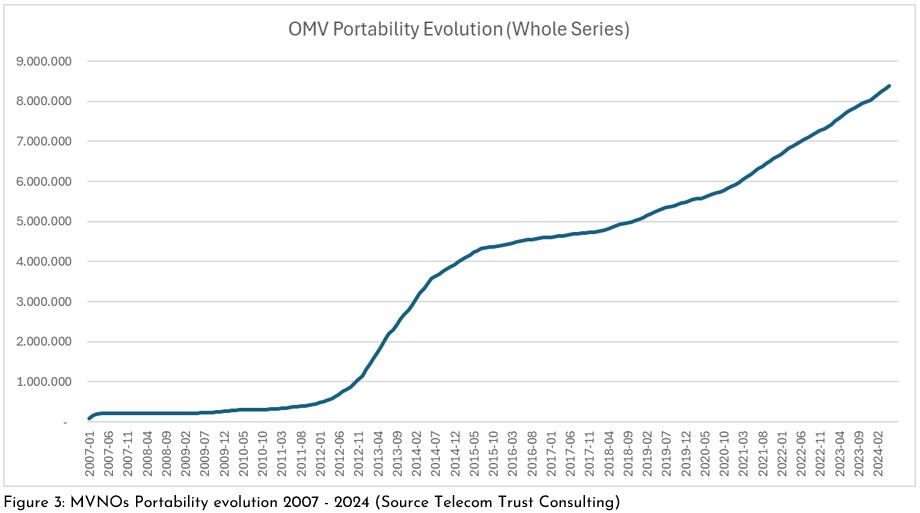

And more important, despite a flat commencement, MVNOs growth has been unstoppable for the last twelve years.

That’s not all folks

Do not miss next chapter, as we will analyse Mobile services offered and how are they marketed in terms of services, pricing and differentiation.

We will see you in the next chapter.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.