1. What a surprise!

Just before the AOTEC fair in Madrid, Vodafone Spain announced a wholesale access agreement with Silbö Telecom for both its mobile and fixed-line networks. But the real breakthrough isn’t simply the agreement with Vodafone — it’s that Silbö will become the first virtual operator (MVNO) in Spain to connect simultaneously to two Mobile Network Operators (MNOs). If properly implemented, this could mark a significant step toward genuine multi-operator integration in Spain’s telecom market.

This move is particularly striking given the long-standing challenges other players have faced in this space. For example, Alai Telecommunications Operator S.L. filed several complaints with Spain’s competition authority (CNMC) regarding restrictive access practices by major MNOs on LPWAN technologies (case references: CFT/DTSA/265/22, CFT/DTSA/278/22, CFT/DTSA/004/23). Similarly, Xfera encountered obstacles related to network interruptions and denied access to 5G services (CFT/DTSA/297/22). These cases underscore just how difficult true multi-operator access has been to achieve in Spain.

The timing of the Silbö announcement also comes as Spain’s telecommunications sector is navigating the fallout of a bitter dispute between FiNetwork and Vodafone — a partnership that once fueled FiNetwork’s rapid rise in the market. Originally launched in 2019 with FiNetwork leveraging Vodafone’s infrastructure, the alliance has now devolved into legal and financial conflict. Vodafone, now owned by British investment firm Zegona, accuses FiNetwork of millions in unpaid debts and has launched legal action, including seeking seizure of FiNetwork’s accounts with CNMC involvement.

In turn, FiNetwork alleges that Vodafone failed to uphold key parts of their wholesale deal, particularly around equal access to network quality — a complaint that highlights exactly why MVNOs are seeking more robust multi-operator access models. The case has not only destabilized the relationship between these two companies but has also raised broader questions about fair access and the future role of MVNOs in Spain’s telecom landscape.

2. Not so new!

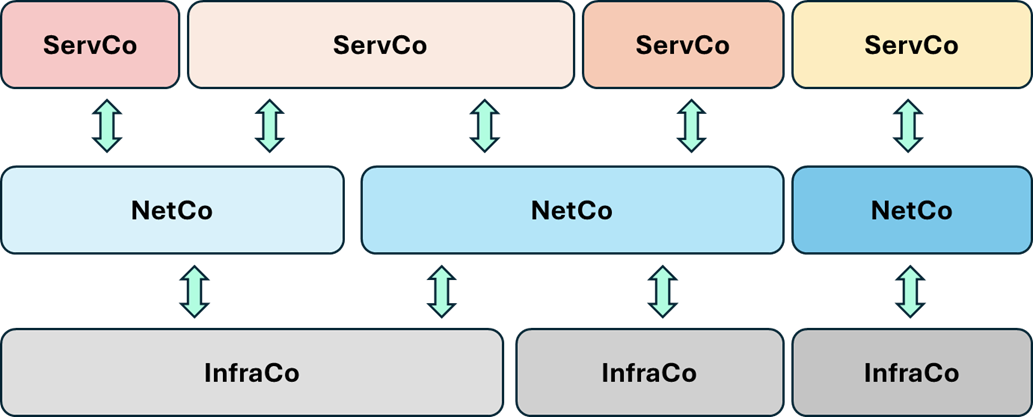

Looking beyond Spain, successful examples of multi-host integrations already exist in other markets. In Mexico, Alestra has deployed a multi-host solution, providing access to the most extensive radio networks in the country through agreements with three of the four main MNOs: Telcel (América Móvil), AT&T México, and the shared/agnostic ALTAN network offering 4G LTE services.

Similarly, in France, Airmob offers multi-host access through Orange, SFR, and Bouygues networks, allowing its customers to always connect via the best available network.

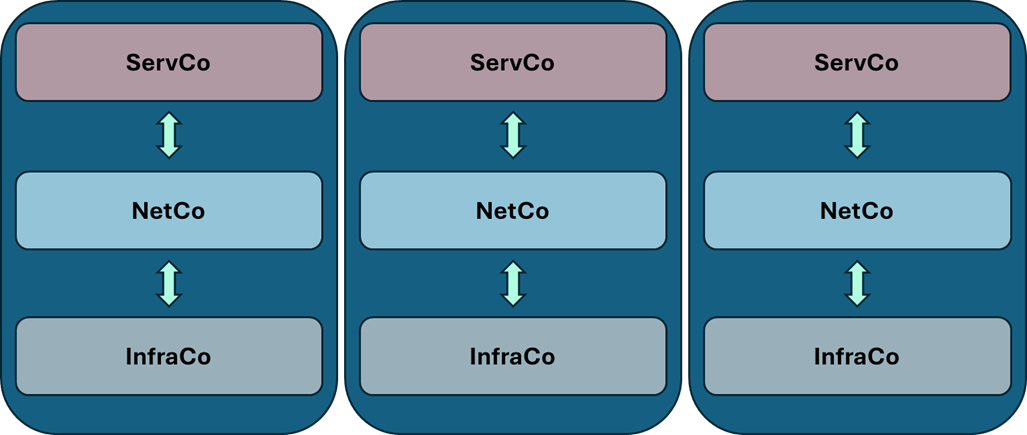

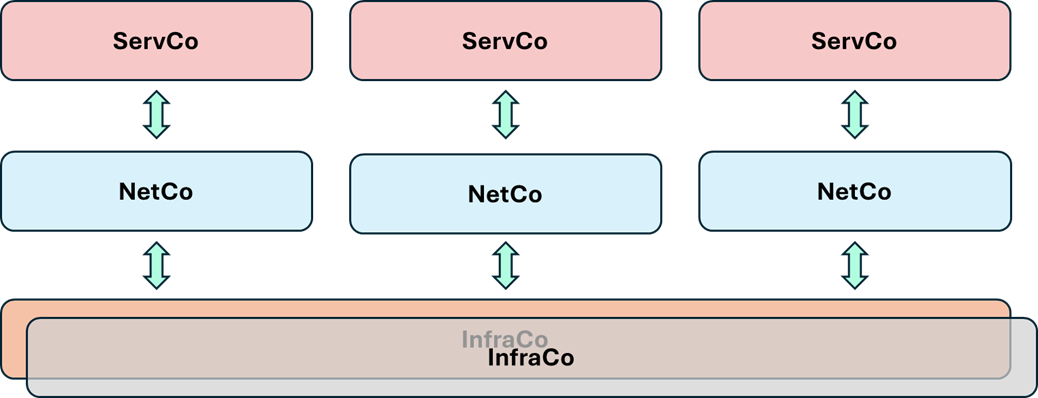

These are not simple multibrand reselling deals — they are genuine multi-operator integrations. Network architectures are evolving beyond the rigid, monolithic deployments of the past toward more flexible, dynamic models.

This trend builds on network-sharing and infrastructure-sharing models that have already been in place for years in many countries, helping operators manage the enormous investments required to maintain and expand access networks.

3. The challenge!

It’s time for MVNOs (ServCos) in Spain to gain similar opportunities: access to multiple providers — at both the infrastructure level (coverage, signal strength, etc.) and network level (4G, 5G NSA, 5G SA, and beyond).

MVNOs that achieve this integration will benefit in multiple ways:

1. Superior Coverage — They can offer the best possible radio network coverage in their tar-get areas by leveraging the combined footprints of multiple Mobile Network Operators.

2. Optimal User Experience — They can ensure their customers benefit from stronger signal strength, higher speeds, improved data traffic performance, and — most importantly — maximum network availability across the widest possible territory.

3. Competitive Costs — By balancing traffic across networks, they can negotiate better pric-ing and maintain competitive cost structures.

4. Operational Resilience — They are no longer tied to a single Mobile Network Operator, reducing the risk of service disruptions in the event of a network outage.

5. Access to Innovation — They can offer customers access to the latest technologies de-ployed across all connected networks, keeping pace with advancements in 4G, 5G NSA, 5G SA, and future developments.

As Spain’s telecom landscape continues to evolve — and legal battles like FiNetwork vs. Vodafone highlight the risks of single-operator dependencies — Silbö’s initiative could represent an im-portant turning point for MVNOs. If successful, it could inspire a more competitive and dynamic market, ultimately benefiting both operators and consumers.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.