Enterprise connectivity is a large market, if not the largest market in the world; Kaleido’s IoT forecast projects there to be 6.7 billion cellular IoT connections worldwide by 2030. The vast majority of these will be used by enterprises, and are a strong opportunity for MVNOs who can provide a coherent platform to manage that connectivity. However, there are also differences in what it means for an enterprise to be connected, which can have an impact on what MVNOs offer as connectivity to their customers.

IoT Enterprise Connectivity

IoT is one of the fastest growing segments in telecoms, although it has relatively little to offer in terms of traditional data revenue, with most connections generating data in the range of megabytes per month. IoT margins are relatively thin, with players like 1NCE offering connectivity for under 10 cents per MB. The primary opportunity here is in VAS (value-added services), which offer capabilities beyond mere connectivity, and customise the offering to clients’ needs. Being able to offer services on top of connectivity is where many of the key benefits are.

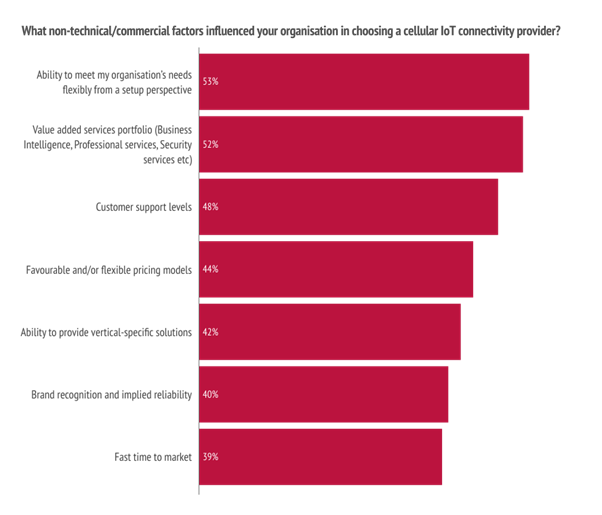

This also means that the providers are doing more than simply offering a capability, but instead can come alongside their customers and become consultative, providing tools and insight. This is something that over half of the respondents to Kaleido’s 2024 IoT Connectivity survey reported they wanted from a connectivity provider, so there is clear opportunity here for MVNOs to step into that role to help enterprise IoT users to maximise the impact of their connectivity.

Source: Kaleido Intelligence 2024 Enterprise IoT Connectivity survey

For MVNEs, this means giving MVNOs the tools to have deep insights into their device fleets, and the ability to enable network adjustment and fine-tuning by as many metrics as possible. There is a large variance here among CMP providers, particularly in regard to which non-telecoms metrics can be used as part of network management, billing and other functionalities. Although many CMPs (connectivity management platforms) offer some degree of customisation, there is still scope for these systems to be utilised differently, and MVNEs to tailor offerings to markets where they have a particular strength. It also means that the line between MVNO and MVNE in the IoT space is very thin, with different operators frequently taking functionality from each other’s systems in a way that is uncommon in the consumer space.

This also complicates the competitive landscape, to some degree; in acquiring the IoT Accelerator CMP from Ericsson, Aeris raised serious concerns from MNOs that it would now be competing with them for IoT customers. This has forced a change in Aeris’ strategy, which has put it back into an MVNE role.

Enterprise Telephony

This is a more conventional offering for enterprises, generally with a different target audience than IoT enterprise connectivity. The primary market here are offices and those with conventional mobile devices. This allows MVNEs to offer a suite of tools similar to a consumer MVNO, to directly manage their own device estate. This is analogous to the provision of a CMP to an IoT user, but it brings additional concerns. The data rates are generally higher, and non-data capabilities are much more commonly required. However, many of the tools for a consumer MVNO can be repurposed to enterprise usage, although subscriber volumes will typically be much lower.

The lower subscriber volume means that, in common with IoT, more emphasis needs to be put on services. These will typically be part of an existing telephony system, requiring incorporation of cellular devices into communications suites such as Microsoft Teams. This will mean that OSS and BSS systems need to be able to handle these specific app requests (including tools like zero rating for critical comms) and bring them into an existing enterprise network environment. Inter-domain security will be a core feature of this, most typically achieved via SIP trunking.

The Through Line of Integration

Both of these use cases rely on being able to integrate different tools into multiple environments. This means that OSS/BSS tools and compatibility with external systems are vital components to any MVNE looking to serve the enterprise market.

This will also often mean incorporating things from other stakeholders; only 23% of cellular IoT user respondents in Kaleido’s survey reported using a single provider for their connectivity, whether MNO or MVNO. There is more scope for unified communications in telephony, although providing wired WANs is also commonly its own specialisation. MVNEs and MVNOs both need to make clear decisions on what enterprise connectivity they will support, with each form needing different software, different partners and different forms of integration.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.