It is counterproductive, but in an increasingly connected world with growing demand for connectivity, monetizing networks has become challenging. For the first time, the market is one of the aspects being considered in the development of the next generation of cellular networks, 6G. Population needs must be aligned with the demand and remuneration of the capital invested in the construction and operation of networks, which is already a challenge in the 5G scenario.

Monetizing 5G networks is one of the most relevant topics today. Until now, telecommunications technologies have been developed based on the needs of the population.

Adding new subscriptions was the name of the game.

The billing model evolved from charging for connection time to fixed subscriptions, and then to charging by data package. The biggest issue faced by operators today is the difficulty of adding new subscriptions. In Brazil, we already have more than one mobile access subscription per inhabitant. Therefore, adding new subscriptions is becoming increasingly complicated.

According to data from the annual service survey by IBGE (2022), the “information and communication” segment was predominant in the gross revenue of services in 14 federation units in 2013, but did not prevail in any of them 10 years later. Monetizing a network by considering only traffic growth does not seem viable, according to a study by consultancy Analysys Mason, mentioned below.

New revenue stream is needed.

Brief history of telecommunications business models

Below are some services and products to illustrate how operators have monetized networks over time.

- Telegraph: charged by character or word, which ultimately reflected the time/effort of sending a message through a communication channel.

- Analog landline telephony: Charging based on call duration (per minute). When making a call, a physical circuit was established, and no one else could use the same circuit during the call.

- Long-distance telephony: The greater the distance, the more infrastructure was needed to interconnect the points, and the more expensive the call minute was.

- Digital landline telephony: As networks expanded their area and interconnected, and digital technologies were introduced, local calls became cheaper until it was possible to establish fixed-rate local subscription plans. Fixed rates were mainly possible due to the ability to share the physical channel through digital communication techniques. With the ability to share infrastructure, operators began to calculate occupancy statistics based on the installed infrastructure.

- Dial-UP: With digital telephony, it became possible to transmit data within telephone networks. Dial-up services were used to transmit data and connect computers to the internet. Despite being used for data transmission, the characteristics of channel occupancy for a certain time led operators to adopt the charging model based on connection time.

- Mobile telephony 1G: Model similar to analog landline telephony, based on time.

- Mobile telephony 2G and 3G: Model similar to 1G, plus SMS message charges. Here, GPRS technology (2.5G) was introduced, allowing data traffic from mobile terminals. Operators also charged per MB consumed.

- Mobile telephony 4G: The model increasingly evolved towards data consumption. We moved from a model where we used the phone to make voice calls (1, 2, and 3G) to a model of uninterrupted data application use. In this model, operators monetize their investments through data package charges.

Crisis of the consumption-based model

We have reached a point where we have more subscriptions and equipment connected to telecommunications networks than people. Therefore, monetizing the network by adding more subscriptions does not seem like a good path.

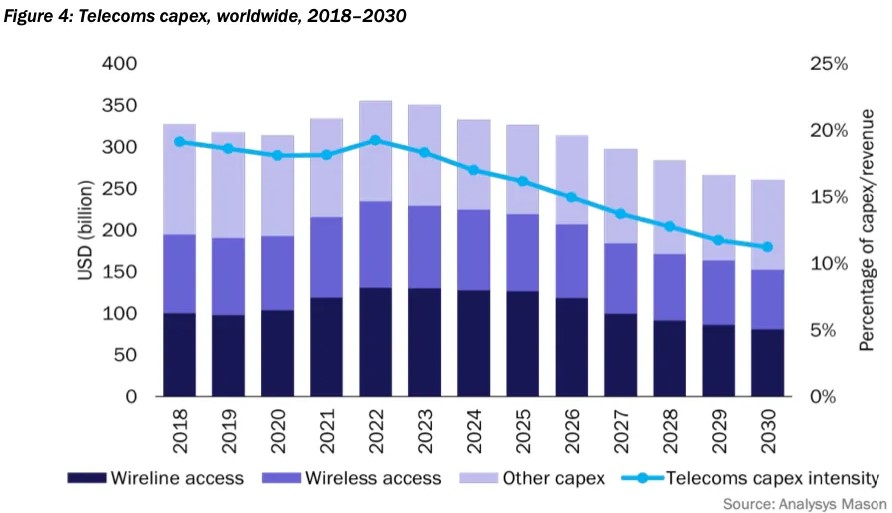

Moreover, expecting revenue to come from increased data volume is also not good, as the current capacity availability seems very high compared to current and future demand. A study by consultancy Analysys Mason indicates saturation in the production of available bandwidth stock.

For the first time, the development of the next generation of mobile telephony is also being guided by the market. Addressing questions about how operators will invest in and monetize 6G networks is a topic being discussed in the development forums of this technology.

In the case of 5G, the hope is that new subscriptions will come through things (IoT – Internet of Things), such as connected cars and other devices that will need to connect to networks.

An interesting aspect of 5G is that it brings three attributes that are rarely used simultaneously:

- eMBB – (Enhanced Mobile Broadband), which provides high data rates

- uRLLC – (Ultra Reliable Low Latency Communication), which provides very low latency mMTC – (Massive Machine Type Communication), high device density per km²

An application should require 1 or 2 of these attributes, rarely all 3 at the same time. This brings the need to adjust the network according to the application, which is possible through network slicing brought in 5G.

OpenGateway: New forms of monetization

One of the lines being discussed as a way to monetize the network is to apply intelligence mechanisms to optimize network utilization. That is, configure the network at the necessary moment to use the correct attribute to provide the best connection quality during the required time.

For example, when starting a machine operation remotely, an application can call the operator’s API and request a slice of the spectrum with maximum priority for the lowest latency.

In this way, the operator can create a differentiated charging model for the time of use of that function. According to a McKinsey survey, about 14% of young people aged 18 to 24 are willing to pay more for connectivity to enhance the performance of their applications during games or streaming. About 15 to 20% of people are willing to pay more for a “business class” 5G plan category, which can bring a temporary connection upgrade.

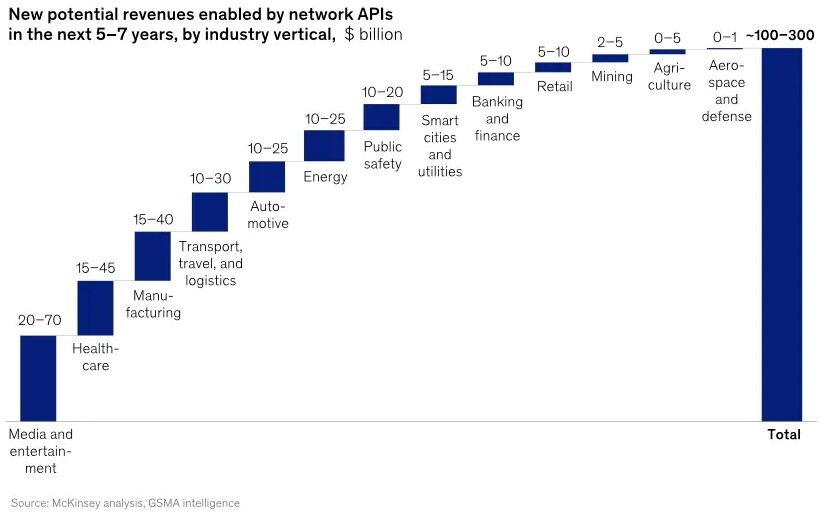

In addition to the functions exposed by the network and network slicing, these capabilities can be easily made available through Open Gateway APIs. According to GSMA Intelligence, $100 to $300 billion should be generated in the next 5 to 7 years with network APIs.

Network APIs offer Telco’s a route to a multi-billion dollar market for connectivity and EDGE-Related services in the coming five to seven years.

This aligns with the Analysys Mason report, which brings three points for creating better networks:

- Smarter Networks

- Greener Networks

- More-durable Networks

Business models have changed as much as technology. In my view, two factors have brought significant leaps in the development of communications and, consequently, in the business model.

- Digitization of communications, which allowed infrastructure sharing and the convergence of image, voice, and data in the form of data consumption.

- Virtualization, which allowed the virtualization of network equipment, uniting the telecommunications world with the software world.

We are beginning to explore the second factor now. 5G networks are entirely software-based and have programmable interfaces (API) between their elements. This enables the exposure of network functions to the outside world, expanding the capacity to develop new products.

Certainly, Artificial Intelligence technologies will come in as a component capable of optimizing the use of these APIs, especially for autonomous applications that will need to mobilize network resources according to infinite variables.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.