We’re approaching the one-year anniversary of the first post Are MVNOs taking AI seriously enough? by our dear friend James Gray—a contributor to this community that we’ve all built together. His most recent post focuses on the integration of MVNOs into financial services, retail, and utilities, a trend we first anticipated back in October 2023 during the MVNO Nation Live Congress held in Valencia, in the presentation “FinTechs, MVNOs and Superapps.”

To mark this anniversary—and for the first time—I’m stepping slightly outside the editorial style of my previous blog posts. With major MVNO-focused events on the horizon in Vienna and Miami (the latter with a special emphasis on the Americas), I want to reach out to Latin American operators and regulators, inviting them to engage in these conversations, given our linguistic and cultural ties.

Shifting the Focus

Today’s article won’t focus on service quality or market analysis, as previous posts have done—both here and on our own blog where we share market insights and trends in the MVNO space. Instead, I want to highlight something vital for prospective MVNOs: the role of regulators—not only during the service delivery phase but especially before launch.

This importance extends beyond just the regulatory frameworks that enable MVNOs to access necessary services from host operators. If you refer to the blog post “How to Create a Business Plan for Your Mobile Brand (MVNO),” on our own section for Market Analysis, you’ll see how crucial it is to have access to reliable market data. This responsibility largely falls on regulators, who must ensure such information is available to foster healthy competition.

Not Just Regulation—Reliable Data

Of course, it’s impractical to analyze every telecom regulator worldwide in a single article, including regional bodies such as:

- BEREC (Body of European Regulators for Electronic Communications) in Europe

- EACO (East African Communications Organisation), which includes Rwanda (RURA), Burundi (ARCT), Kenya (CA), Tanzania (TCRA), among others

However, it’s not my aim to list all of them here.

Useful links can be found through certain institutions like Nicaragua’s Instituto Nicaragüense de Telecomunicaciones y Correos (TELCOR) or even Wikipedia, though these are not comprehensive.

The purpose of this article is to encourage regulators to share—or at least assist in compiling—high-quality, reliable statistics. This data should help create an objective and insightful view of local markets, aiding both prospective and existing MVNOs in strategic decision-making.

A Closer Look: Latin America and the Caribbean

The Latin American and Caribbean markets are incredibly diverse—from populous nations like Brazil and Mexico to smaller island countries. This diversity extends to the operators and, notably, the availability and transparency of information provided by their respective regulators.

Over the past few weeks, we’ve studied several markets, which serve as examples of best practices:

Chile

Chile

Chile’s telecom regulator provides extensive information on mobile telephony, including:

- Historical trends in subscriber numbers

- Breakdown by commercial plan (prepaid vs. postpaid)

- Customer type (residential vs. business)

- Operator-specific data

This enables a deep understanding of market dynamics.

Additionally, Chile offers excellent data on number portability, an increasingly relevant metric in saturated markets (with >100% penetration), allowing us to track subscriber flows between operators.

However, not all data categories are consistently updated—some key statistics haven’t been refreshed in years, which limits their usefulness.

Mexico

Mexico

With over 148 million mobile lines, Mexico is a major market. Its Banco de Información de Telecomunicaciones (BIT) offers a wealth of downloadable data, along with numerous reports—such as quarterly “Telecommunications Sector Timely Information Reports.”

Colombia

Colombia

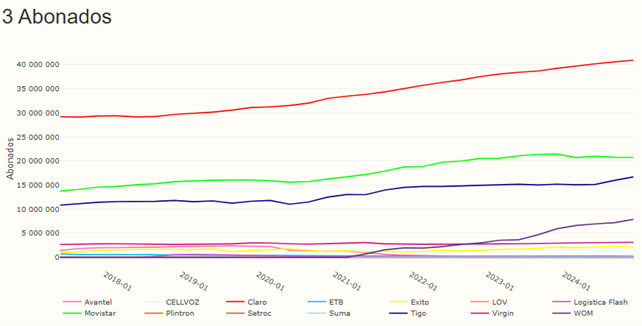

As mentioned in our earlier Colombia Market Analysis, Análisis de Colombia, the CRC’s open data platform stands out for both:

- Numerical datasets for in-depth analysis

- Interactive visualizations for a quick grasp of market trends

Peru

Peru

Peru also offers a wealth of high-quality information. Regulators provide multiple access points to various online tools, streamlining navigation and improving transparency.

The Value of Transparency

Access to verified, regulator-backed information—as a supplement to what public operators must disclose (especially those that are publicly traded)—is essential. It empowers industry professionals, especially consultants, to assess market health and guide MVNOs, whether emerging or established, in making informed strategic decisions.

While we’ve focused on Latin America here, it’s worth noting that:

- Much of the data is available only in Spanish (though AI and translation tools mitigate this)

- Other regions may publish data in various languages, including Arabic

- Some publish in non-editable formats, which hinders automated translation and analysis

Final Thoughts

Encouraging regulators to prioritize transparency and structured data sharing isn’t just beneficial—it’s necessary. It strengthens markets, supports competition, and equips MVNOs with the insights they need to succeed.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.

Chile

Chile Mexico

Mexico Colombia

Colombia Peru

Peru