MNOs have something of a complicated relationship with MVNOs; while they can bring more customers into the network they can also be seen as potentially cannibalising the MNO’s market share, reducing the ARPU an operator receives from their connections. The short answer is that MVNOs can be all these things to an MNO, broadly falling into 3 categories:

- an owned subsidiary broadening the MNO’s addressable market (like AT&T’s Cricket Wireless).

- a reseller of an MNO’s connectivity to markets that they would not otherwise reach (like 1NCE’s relationship with Deutsche Telekom).

- a wholly independent entity offering connectivity to end users through independent agreements with multiple MNOs (such as the way Wireless Logic operates).

This is particularly important as MVNOs are encouraged in several markets (particularly in Europe) as price competition on MNOs. With this presence and potentially hostile relationship in mind, there need to be ways to mitigate this and provide MNOs with compelling reasons to partner with MVNOs, rather than shut them out.

Lessening the MVNO ‘Threat’

The primary problem that MVNOs pose for MNOs is why they are not the MNOs’ direct customers, and each MVNO needs to provide an answer to that. Being ready to offer incremental revenues to MNOs, rather than cannibalisation, is a key element in dealing with MNOs. MVNOs can best find differentiation from MNOs by providing services in addition to connectivity, areas not typically offered by MNOs directly.

These can fall into three categories:

Network Services:

Through providing service-based monetisation, MVNOs can offer customised networks, incorporating different connectivity types in the end solution as required. Often, MNOs are focused on cellular for all use cases, while MVNOs can leverage whatever connectivity best suits their client’s use case.

Vertical Expertise:

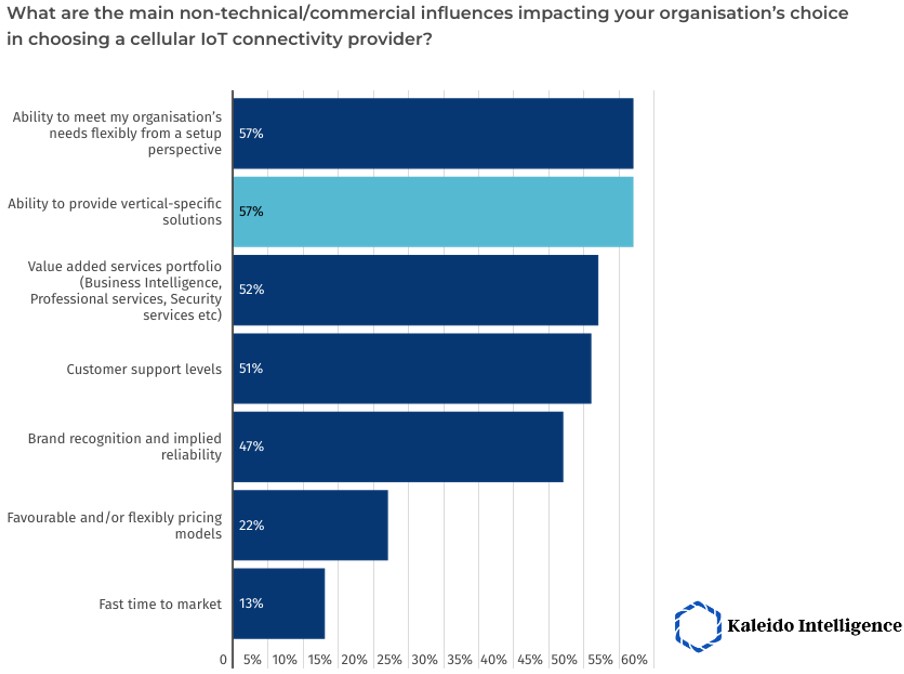

Kaleido’s 2023 survey of 800 enterprises found that 57% of enterprises using cellular IoT want vertical-specific solutions from their connectivity provider. MVNOs have generally been nimbler in this regard, and able to offer more specific solutions.

Membership Services:

MVNOs can cover a far wider range of brands than MNOs, and so can bundle the connectivity provision into other services to retail customers. This can include memberships of a variety of retail clubs or discount schemes, which will increase stickiness for the MVNO’s other services that an MNO would never offer.

Using these elements MVNOs can treat the connectivity they get from an MNO as part of a broader service, and lessen the degree of direct competition with MNOs, while more directly serving their clients’ needs. Within IoT, however, there is growing momentum among operators to provide this via wholly owned subsidiaries, such as Telefónica Tech and Vodafone Business. IoT MVNOs will have to work hard here to keep their reputation as specialists in the face of MNOs’ larger overall market presence.

MVNO as Sales Channel

MVNOs can operate as resellers for MNOs’ connectivity, even if they are not direct subsidiaries of the MNO. Prices agreed in these direct arrangements can offer arrangements above wholesale rates and thus maintain higher margins for the MNO than raw wholesale connectivity, although doing so may reduce the MVNO’s ability to offer competitive pricing and remain profitable. More useful here for MNOs is the ability to specify that they will use the MNO’s footprint (and possibly include roaming agreements), excluding the MNO’s competition from receiving wholesale revenue from the MVNO.

MVNOs in this position can theoretically use their MNO sponsor to gain favourable roaming rates, keep prices relatively low, and access many markets through their sponsor’s existing agreements. However, this is very dependent on good relations with the sponsoring MNO, and if the underlying rates are hiked or withdrawn it can be detrimental to the MVNO’s margins. This model hands over control of the MVNO to the MNO to a large degree, which may not be comfortable for more independent MVNOs.

MNO as Partner for the Best Connectivity

With the advent of 5G, many IoT use cases are dependent on a certain service level for their effectiveness, necessitating an ability to guarantee that service level. Even in places where this is not a necessity, it has a large impact on service adoption, and poor connectivity experiences can lead to customer churn. Kaleido’s cellular IoT survey found that quality of service was the #1 technical feature influencing connectivity provider choice for 50% of current cellular IoT users. Several IoT MVNOs are now using multi-IMSI SIMs and signal strength metrics to determine which connection to utilise, making the promise of good service quality in a range of countries. This allows MVNOs to offer MNOs connections based on what quality can be offered, encouraging MNOs to provide strong connectivity for connections that require it. This can lead to higher-value connections being brought in by MVNOs, increasing data revenue for both parties, based on provision of quality connectivity for the end user.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.