Network operator roaming charges are somewhat infamous for their cost in many countries, and as a result, a large number of travellers go ‘silent.’ Indeed, a recent survey has shown that, across 20 international markets with high volumes of international travel, at least 20% of travellers in these markets do not use roaming, which can reach over 50% in some markets. This includes those who rely purely on Wi-Fi, as well as local SIM and eSIM users.

eSIMs represent a strong opportunity to monetise silent roamers, although the technology primarily competes with Wi-Fi for its usage. As Wi-Fi is typically free, it offers a strong value proposition to roaming, where daily charges or bundle purchases are common. Indeed, 16% of roamers across all countries surveyed report they start looking for an alternative option for their connectivity after any increase at all in their phone usage charges. This will not make much difference in European countries where roam-like-at-home (RLAH) deals are common, but elsewhere, it can drive many roamers to stop using the service. It is also a potential barrier to eSIM adoption, as although 1 in 3 respondents believe roaming alternatives like eSIM can enhance their connectivity, a similar number worry that they would risk over-paying for connectivity. MVNOs looking to offer eSIMs to consumers therefore need to communicate the value of eSIM more clearly to capture those wanting cheaper connectivity.

Cost is a major factor in travellers’ decisions to use or not use roaming. However, while lower costs were typically the biggest reason to use roaming alternatives, 42% of users across the surveyed markets reported that roaming alternatives were more convenient for them, with higher numbers in APAC countries. This means that presenting travellers with convenient connectivity experiences will still appeal to large numbers of travellers, even where MVNOs offering eSIMs may not be able to be price competitive with roaming (eg in a RLAH context, or where the roaming partner is a subsidiary of a user’s home MSP (Mobile Service Provider)).

There is clear appeal in the technology itself, as well, at least for a trial basis; consumers who do not use roaming alternatives were asked about their willingness to use eSIM; overall, 79% of respondents reported they were quite likely or very likely to use eSIM for their future international travel, if they could. With this degree of receptivity, simple exposure could lead to significant adoption of eSIM. Indeed, 27% of current eSIM users reported they use the technology at least in part because of a promotional offer they received.

This is an opportunity for MVNOs that serve travellers’ home markets to secure eSIM users, as 62% of travellers who use connectivity abroad make arrangements to do so before they leave their home country. Indeed, eSIMs could be offered alongside or in place of roaming bundles for MSPs in many cases, to capitalise on traditional channels.

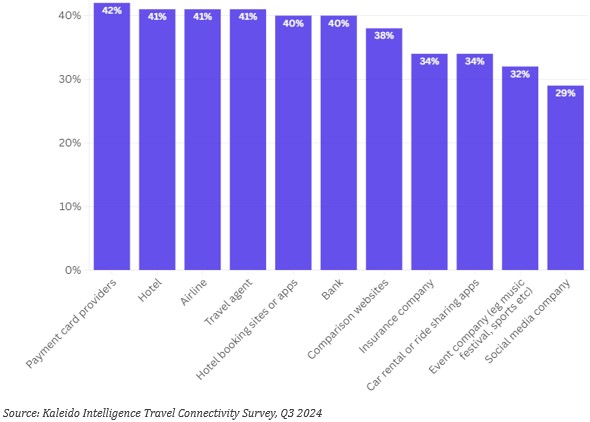

A more profitable option that has not been highly explored to date is the possibility of other stakeholders acting as MVNOs that can offer eSIMs. Many of these are already in the travel ecosystem, and have a relationship with the traveller; 41% of current eSIM non-users overall reported they would be likely or very likely to buy an eSIM from a hotel, airline or travel agent, while 42% are likely to do so from a payment services provider. We have already seen this with launches from Revolut, Nubank and other neobanks throughout 2024, and our survey shows that there is a large addressable market for others to offer eSIMs as part of their existing relationship with travellers.

Proportion of respondents quite/very likely to buy travel eSIMs from each type of company.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.