With its 8,515 thousand km² and just over 212 million people, Brazil is the largest country in Latin America. If Latin America were a country, it would be the 3rd largest in the world, with 600 million inhabitants and a GDP of USD 5.8 trillion. Brazil represents 33% of this market.

However, Brazil faces several challenges, and a major one concerns connectivity for the Internet of Things (IoT). According to the National Telecommunications Agency, Brazil has more mobile subscriptions than inhabitants, with 261.6 million mobile access subscriptions, of which 241.4 million are mobile broadband subscription accesses. Mobile Broadband Subscriptions will be designated as Consumer Subscriptions for the purpose of this article.

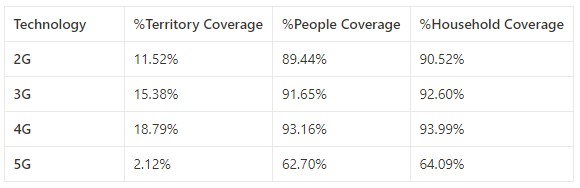

The table below shows the relationship between mobile telephony coverage for people and households versus territorial extension coverage.

It is evident that mobile operators prioritize service availability in areas with good population density. However, the digital future requires things to be connected, and therefore, bringing mobile connectivity to a country like Brazil is a challenge.

Brief History

To achieve this level of mobile access subscriptions, Brazil has undergone several regulatory changes and public policies, requiring operators (MNOs) to meet certain coverage criteria to exploit mobile telephone service in the SMP (Serviço Móvel Privado, or Private Mobile Service) category.

In November 2010, Anatel implemented policies that allowed MVNOs business in Brazil. This was expected to open the market to virtual operators wishing to explore the service in the full or accredited mode.

As everywhere, niche operators make a lot of sense in this segment, and in 2015 Mais AD was the first MVNO to establish itself in Brazil. Mais AD provided voice and data services to the faithful of the Pentecostal Churches of the Assembly of God in Brazil. As an accredited MVNO, it ceased its operations in 2020.

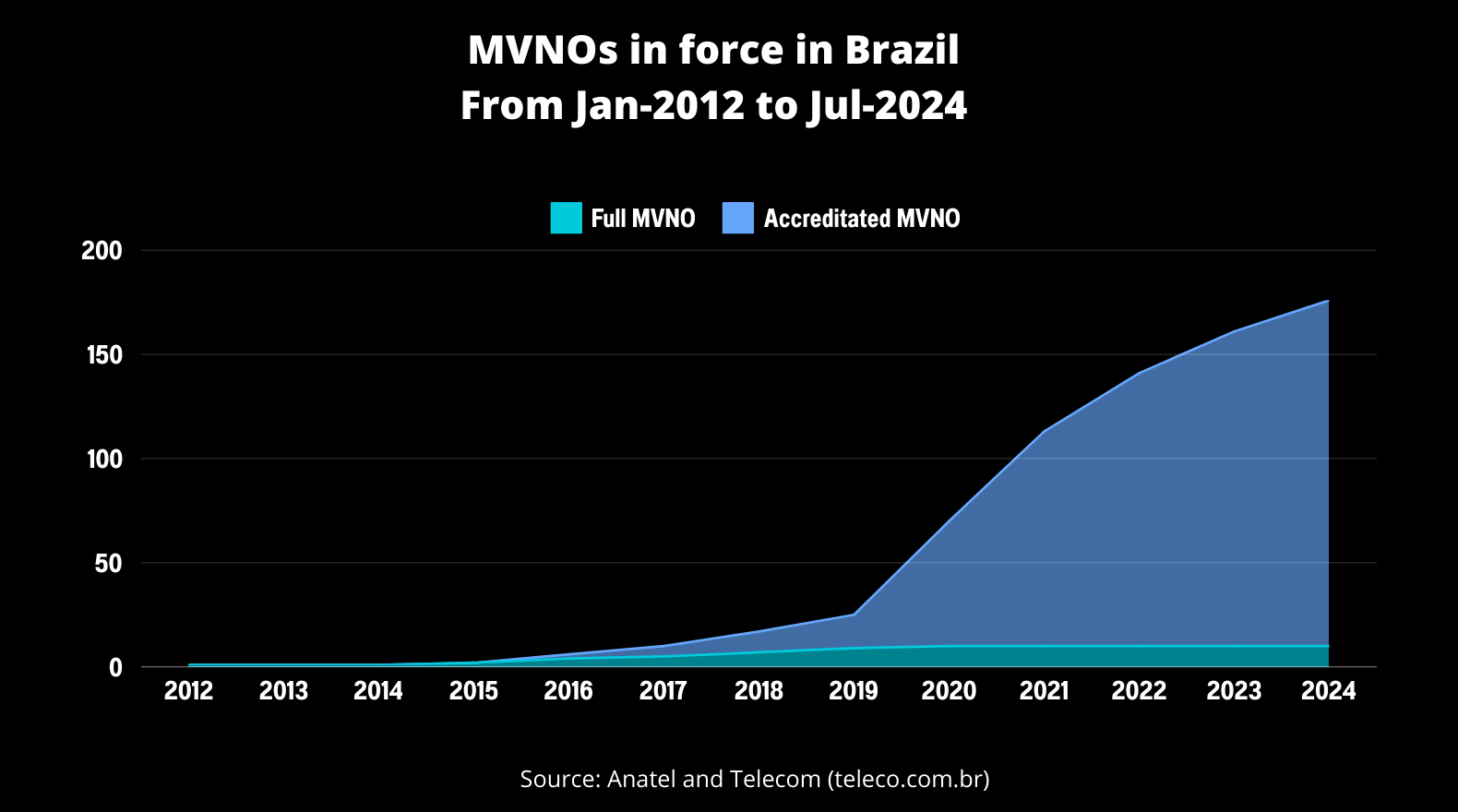

Currently, there are 166 accredited MVNO contracts in force, operated by 157 companies.

The rise of MVNO

Due to its continental dimensions, Brazil saw the emergence of a SIM card resale business model, marketed through Communication Service Providers. These are companies that connect to MNOs via IPSec VPNs and contract SIM cards in volume to resell to smaller companies. These companies have the capability of traffic aggregation from multiple operators and provide a connectivity management platform with consolidated billing, fulfillment, and technical support information from operators. This way, the client has a management portal for all their SIM subscriptions, greatly simplifying the management of the SIM card fleet. This emerged around the 2000s and was a game changer for fleet management.

The way of acting as a connectivity reseller requires compliance with ANATEL rules, and therefore, regulation by CSPs is necessary. MVNO licenses regularize this type of commercialization. However, the market was hesitant about adhering to these licenses, as there are regulatory barriers, tax issues, and commercial conditions that make entrepreneurs think twice before authorizing or accrediting themselves with an MNO or MVNO.

The MVNO model, public policies, and taxation have evolved significantly since 2016. The result was a “boom” in the number of accredited MVNOs, especially from 2020 onwards.

An old market demand was sanctioned in January 2021, the FISTEL charge for M2M connections. FISTEL is a fee that must be paid annually at activation and maintenance of the subscription. In 2020, the value was almost USD 1.00 as an initial fee, and USD 0.34 annually per active device. Currently, only POS connections (those for credit card machines) are subject to this fee.

This may have been a trigger that encouraged the entry of new accredited MVNOs into the market, as seen in the graph above. We went from 25 accredited MVNO contracts to 166.

In addition, we have 10 Full MVNOs in Brazil.

Contribution of Full MVNOs to Accreditated MVNOs

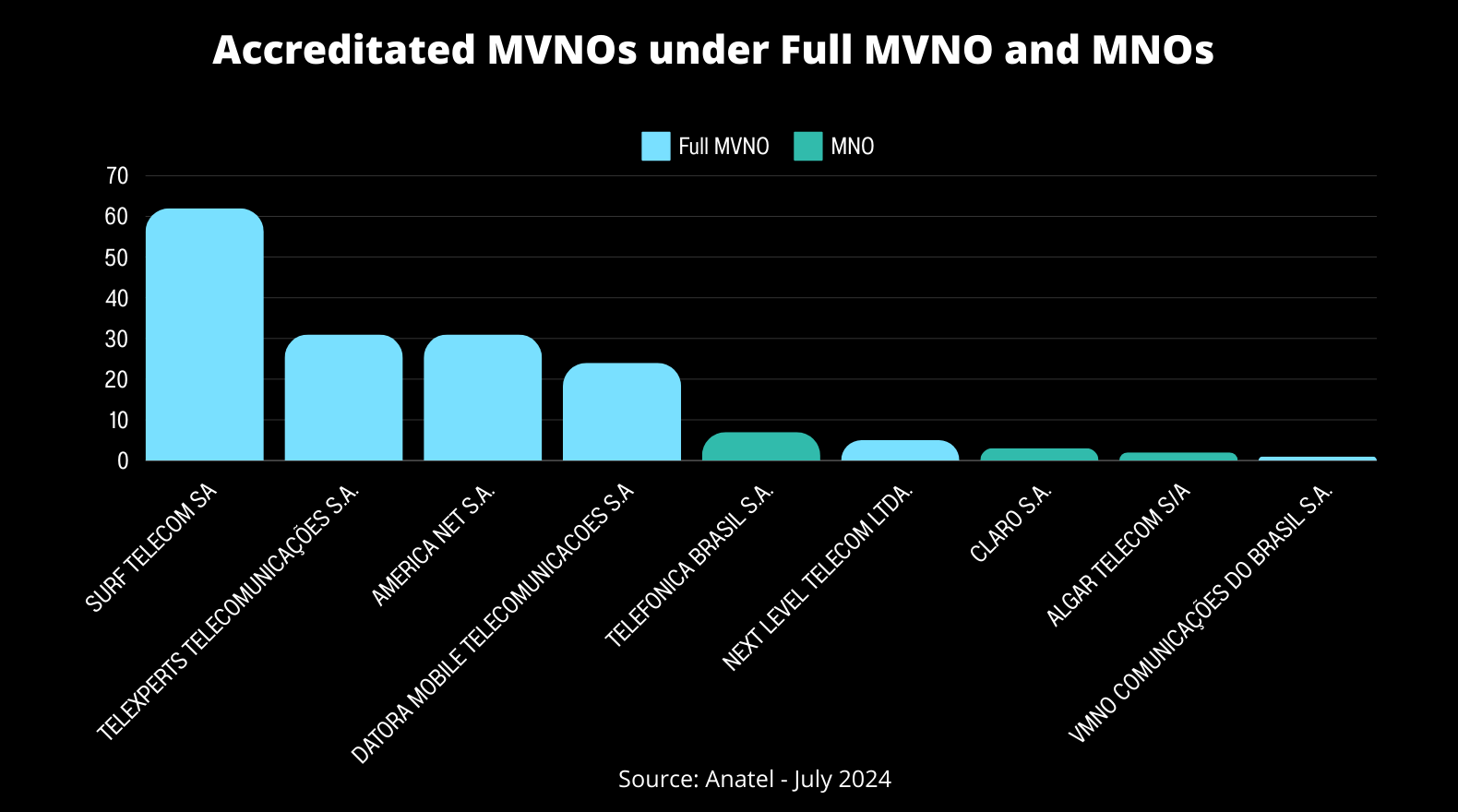

The table below shows the distribution of the 166 contracts among MNOs and full MVNOs.

A better view of the distribution is shown below:

Notice that we have 12 MVNOs accredited on the networks of MNOs (Telefonica Brasil, Claro, and Algar Telecom) and 154 MVNOs accredited into the full MVNOs (all others). It can be inferred that there is a strategy from the full MVNOs for the accreditation of partners who wish to regularize themselves and act as MVNOs. Some of the full MVNOs are providing MVNE services.

The rise of IoT

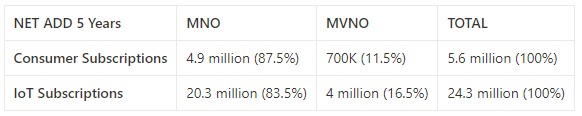

Regarding the growth of the mobile subscription base, according to Anatel data, the market grew by 13% over the last 5 years (as of January 2024), with a net addition of almost 30 million subscriptions. Of these, 25.4 million (84.6%) came from MNOs, and 4.6 million (15.4%) came from full MVNOs.

When broken down by type of service those 30 million added subscriptions are 24.3 million of IoT subscriptions (M2M+POS), with 20.3 million coming from MNOs and 4 million from MVNOs.

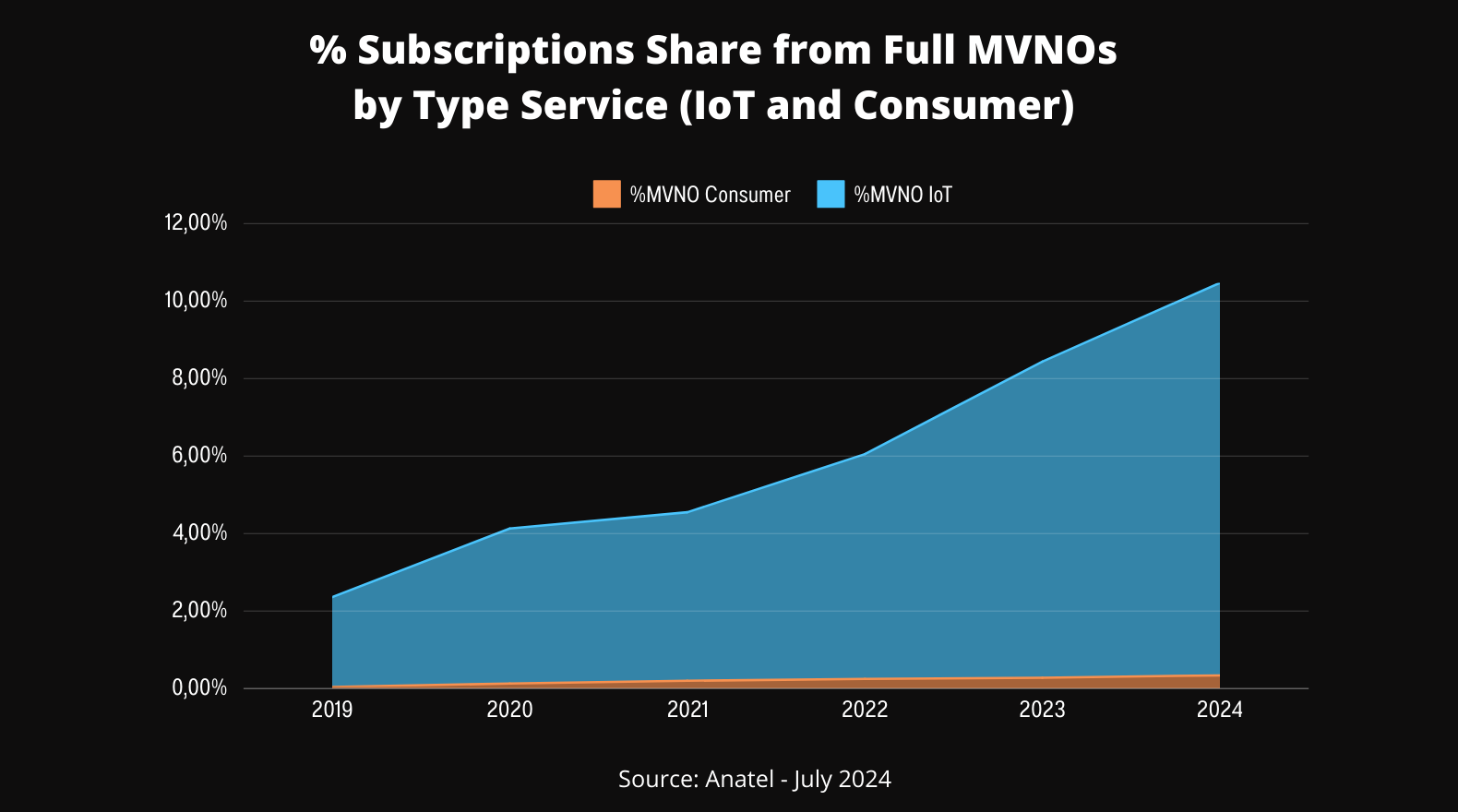

When comparing the evolution of Full MVNO participation, we see that MVNOs exploring the IoT segment have had a higher growth rate in participation in additions over time compared to Consumer subscriptions.

In the same period,, we went from 0,04% to 0,34% in representativeness in mobile subscription additions by MVNOs, while we went from about 2,32% to 10,13% in the IoT segment.

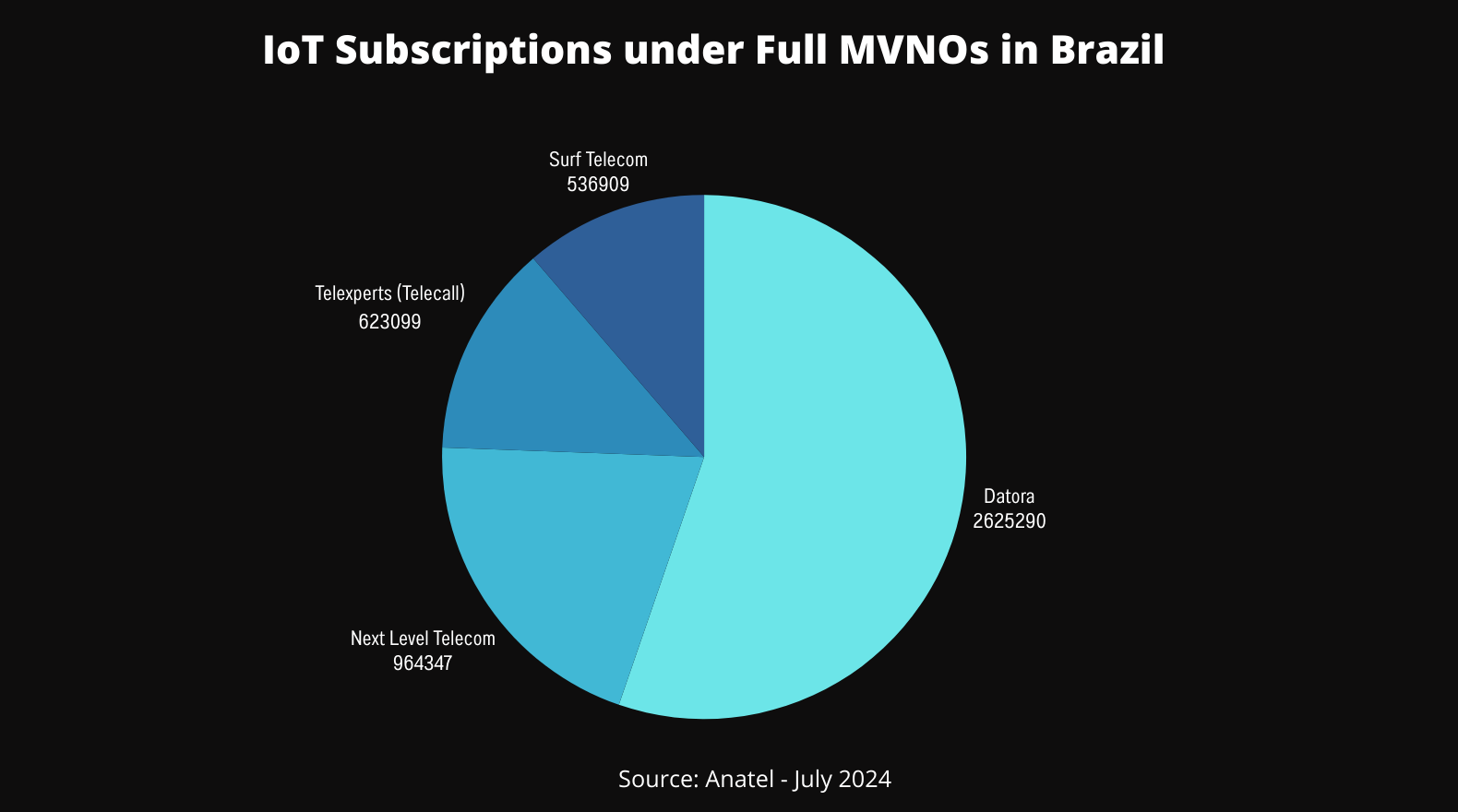

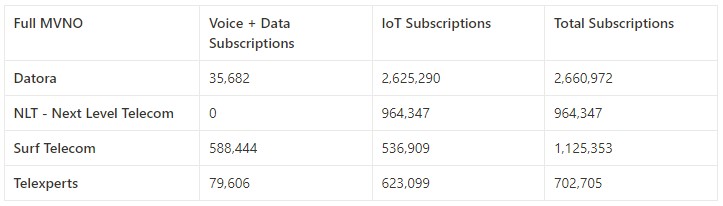

Finally, the Full MVNOs reported 4.8 million IoT subscriptions in July 2024, distributed as below:

The table below shows the distribution of Consumer and IoT Subscriptions in the MVNO that reported at least 1 IoT subscription:

Datora and NLT (Next Level Telecom) has more focus in IoT Market. They experienced a high growth rate in the last years. With the exception of Surf Telecom, the other three companies experienced IoT growth that was much higher than Voice.

Datora was authorized in 2012, Surf Telecom in 2015, and both operate on the TIM network. Telecall was authorized in 2018 and Next Level Telecom in 2018, both operating on the Vivo network.

What is the advantage from a Full MVNO?

Complete management over IMSI resources, numbering, and Core Network enables the full MVNO to integrate into other networks and package services that are fundamental for IoT applications.

In the Consumer market, customers seek quality and almost always associate with the brand.

This is different in IoT, where the customer seeks network availability, in addition to other attributes. Therefore, the ability to integrate to provide high network availability and security is a critical success factor in the IoT connectivity market.

Unlike MNOs, which have a huge number of legacy systems and platforms, full MVNOs can start from scratch and/or implement systems with high integration capacity with partners and customization for the end customer.

As explained a few sections ago, Brazil has been working on regulatory aspects and creating policies for IoT deployment. When we look at Brazil’s history, it seems that policies have been effective. But our guidelines must take into account global evolution.

The current IoT access base in Brazil is almost 45 million accesses. This represents a penetration rate of 21% when compared to the population of 212 million inhabitants – in 2022, the rate was 18.1% according to the Going Digital Toolkit – OECD website.

If we compare with the USA, which has an area (9,834 thousand km²) and population (333 million) similar to Brazil, in 2022 the rate there was 56.2%. This would give a volume of IoT connections of 187 million connections in 2022, a lack of 142 million access in Brazil. This could be a way to measure the size of the opportunity in Brazil?

Maybe. Factors such as energy transition, agricultural needs, climate change and much others demand the adoption of Internet of Things technologies on a large scale. Technologies like 5G, NTN; and in 6 years, 6G highlight the needs to think about more aggressive policies to leverage IoT in Brazil.

In future articles, I will bring some thoughts on the current state, implemented and evaluated policies, challenges, and opportunities for MVNOs to explore the IoT service in Brazil and Latin America.

Guest Blogs are written by carefully selected Experts. If you also want to create a Guest blog then Contact us.